Running a business and managing a workforce are inherently risk-laden endeavors. But managers can be proactive in avoiding the costly nightmare of an employee lawsuit.

Employment issues such as hiring independent contractors, employee classification, staff conduct, and wage requirements that require diligent HR best practices to ensure proper HR compliance.

A strategic practice for HR management is to develop and implement processes that require regular review and updating of compliance procedures. This is a necessity in light of constantly changing labor laws and shouldn't be done randomly nor be reliant on a simple, cursory overview.

A "best practice" for ensuring consistent compliance with labor law changes is to designate one staff member to be accountable for researching and updating compliance policies. This way you can be assured that your HR and payroll management practices are always up to date and in compliance with any changes.

California Labor Law Compliance and Discrimination

Employers cannot discriminate in their hiring decisions based upon race, color, religion, sex, age, disability or national origin. Employers are also restricted in the types of questions that can be asked in a pre-employment interview. The same legal restrictions for hiring apply to any pre-employment interview process, as well.

The U.S. Equal Employment Opportunity Commission (EEOC) is responsible for enforcing the nation's anti-discrimination laws. The EEOC website is a good resource for small business owners that provides information that highlights some of the primary areas which can cause potential legal trouble employers.

In California, state level employee discrimination claims are submitted to the California Department of Fair Employment and Housing (DFEH). The California anti-discrimination statute covers some smaller employers that are not covered by federal law, according the agency website. These smaller employers are defined as workplaces with between 5 and 14 employees. For harassment claims, the designation is a business with one or more employees.

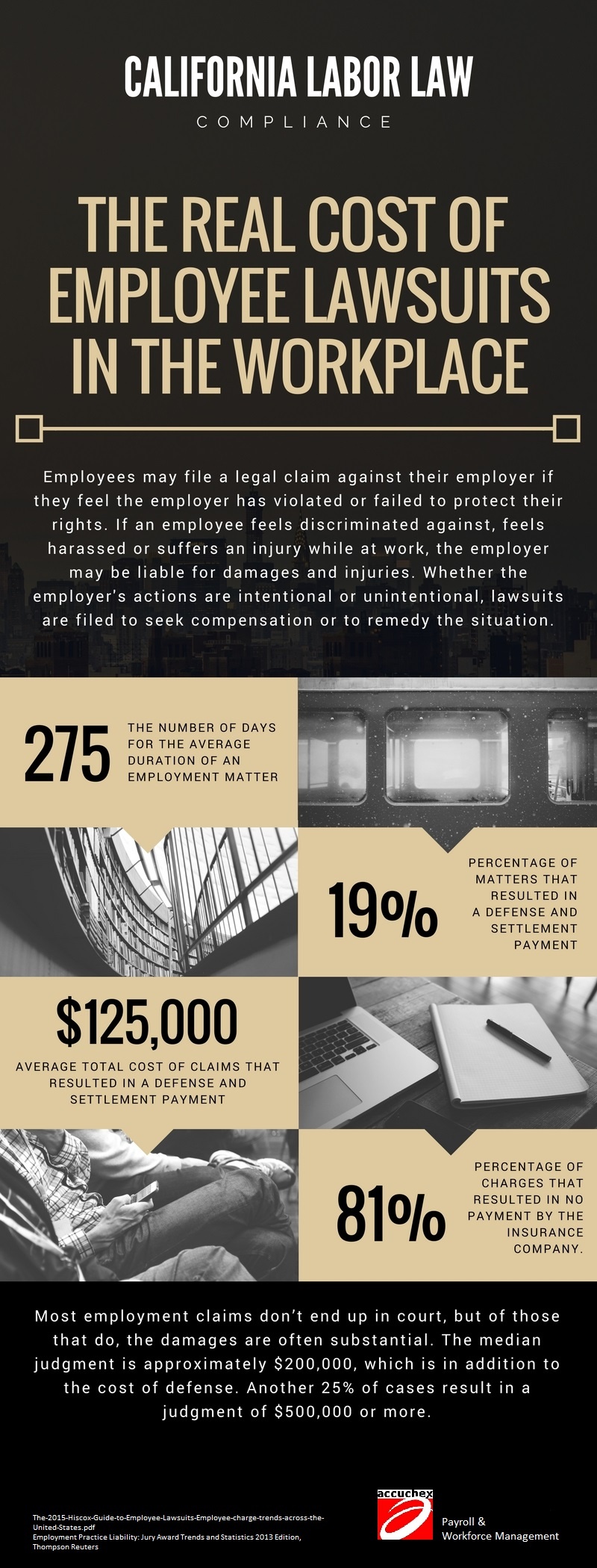

Employee Lawsuits Can Be Costly

No matter whether a complaint or lawsuit is decided in favor of an employer or employer, the related costs for the employer can be significant, even crippling.

Avoiding Employee Misclassification

The consequences of dealing with allegations of employee misclassification can be time-consuming and costly, especially in California. This can include fines, fees and penalties, lawsuits and, in some cases, even jail time.

Depending on the severity of the infractions involved, the fines levied by the U.S. Department of Labor (DOL), the IRS and other state agencies can be in the millions. Consequently, compliance and due diligence in employee classification should be managed carefully because of the very real threat of employee claims and class action suits.

In addition to the simple employee misclassification mistakes that can be made, employers must avoid wage law violations, I-9 violations, unemployment insurance issues, improper exclusion from benefits, worker’s comp violations, anti-discrimination violations, FMLA violations, and more.

Misclassification Fines and Penalties

Here are the potential costs faced by employers even for unintentional misclassification:

- $50 for each Form W-2 the employer failed to file by classifying workers as independent contractors

- 5 percent of the wages for failure to withhold income taxes

- 40 percent of FICA taxes that not withheld from the employee

- 100 percent of matching FICA taxes the employer should have paid

- Interest accrued on penalties daily from the date they should have been deposited

- Additional IRS fines and penalties if it suspects fraud or intentional misconduct

California's Three-Part "ABC" Employee Classification Test

In California, employers must be able to meet or satisfy all three parts of what is known as the ABC Test to classify a worker as an independent contractors. These conditions are:

• The worker is not under the control and direction of the employer in relation to the performance of the work, both under the contract and in fact;

• The worker also performs work that is outside the usual course of the employer’s business; AND

• The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work being performed for the employer

If the employer cannot verify that a worker is a contract worker based on this test, that worker must be classified as a W-2 employee.

Another way of framing this issue is, "If you tell a worker when, where and how to work, you do not have a contractor relationship: that person is an employee.”

Clarifying Between Exempt and Nonexempt Status

One cause of employee claims is incorrectly classifying employees when it comes to overtime pay. Employers having individuals working overtime as exempt employees when their classification status should be nonexempt is a common example. This is sometimes done intentionally to avoid paying overtime pay.

However, this is illegal and increased enforcement by the IRS and various state agencies means that businesses must be fully compliant in regards to the proper classification of all their workers.

All employees, either designated exempt or nonexempt, are covered under the Fair Labor Standards Act (FLSA). Normally, all salaried employees are exempt and, as a result, are not paid for overtime pay. Nonexempt employees, on the other hand, are paid hourly and must be paid overtime for any hours worked over a normal workday or workweek, in most situations.

A change to the salary threshold was put forward by the FSLA under President Obama, and was referred to as the Final Rule. However, since the recent administration took office the so-called Final Rule did not go into effect and is currently under review.

For now, businesses must continue to use the existing criteria to determine if an employee is to be considered exempt or nonexempt.

These criteria include:

- Employees earning less than $455 per week are nonexempt

- The basis test means that a salaried employee generally has a specific amount that they can count on each pay period

- The job duties test generally means that those with managerial duties and the ability to hire and fire are exempt employees

It is essential for employers to be in full compliance with these classification rules. There have been record numbers of lawsuits filed in recent years, especially in California, due to alleged violations of the FLSA. It's been suggested that a major reason behind this increase in claims is a better understanding of proper employee classification on the part of workers.

HR Management Best Practices for California Labor Law

Outsourcing HR functions is an increasingly common strategy for small businesses and the advantages are worth asking about. In addition to reducing your in-house costs, increasing accuracy and security, you can also benefit by freeing your HR resources for improving operational functions, recruiting efforts, and training.

When it comes to payroll management, you have a number of options for your HR and payroll staff. Software that can be installed in-house, or cloud-based programs offer a good alternative. But if you really want to take full advantage of the benefits available to you, outsourcing to a provider like Accuchex can still be the best decision.

Reliability, full-service options, and reputation are the hallmarks of a quality HR management service provider. If you are currently looking to invest in outsourcing you get your Free Download: California Labor Law guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.