California is famous for many things. But being one of the least expensive places to run a business is not one of them. In fact, the opposite is true.

Being an employer in California is a challenging venture. And managing the costs involved in hiring employees can seem prohibitive, as well. With increased family leave, paid sick leave, and other costly benefits - not to mention an ever-increasing minimum wage scale - it is a daunting task to make a business cost effective and profitable.

This is why a fiscal and operational strategy must carefully take into consideration the real and actual costs of a new hire before committing to recruiting candidates.

Hiring an Employee In California Can Be An Expensive Undertaking

It's easy to overlook the fact that there is more at stake than the prospective salary of a new hire. An employer must consider the accumulated costs of recruiting, screening, hiring, training and integrating a new employee into the workplace. Depending on the position and the type of business, these costs can up to thousands of dollars.

Not every employee will require the entire process, but even an $10 an hour employee can end up costing a company close to $4,000 in turnover costs, both direct and indirect. Then there is the ever present risk of either losing a new employee, or having to let them go and find a replacement.

California: The Rising Costs of a New Hire in the Golden State

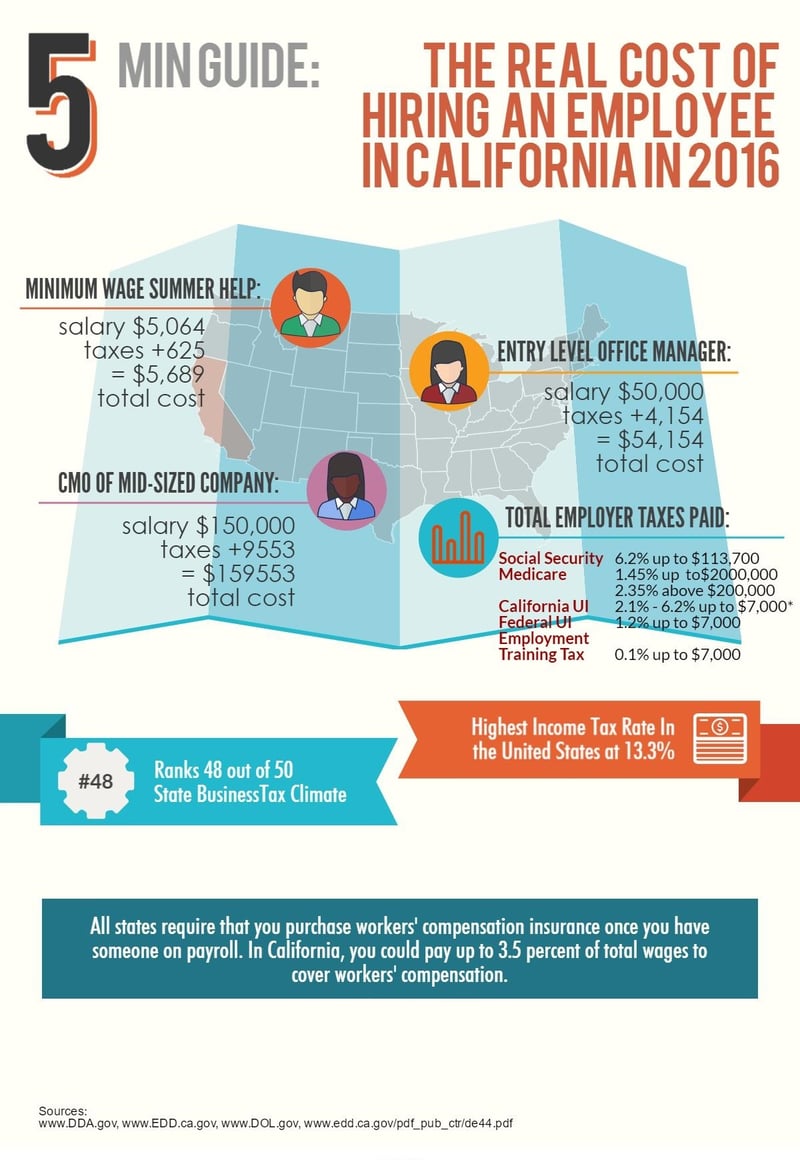

While it may not be news to most employers in California, seeing the actual costs associated with bringing on a new hire can be sobering. Employer contributions to payroll taxes are among the highest in the nation.

Add to that the fact that the overall business tax climate ranks near the bottom out of 50 states, and the added costs of the highest income tax rate in the nation, and it is easy to see why payroll management and optimizing human resources is a priority for California businesses.

To illustrate these facts we've created a quick visual guide to some comparative hiring costs for new employees in California:

In addition to these relatively fixed payroll contributions, the FUTA tax is set to increase at least for the next year, until 2018, which will drive the employer share up incrementally year after year.

Why it Pays to Have Professional Help With Payroll Management

One of the key strategies for reducing overhead, employee costs, and streamlining operations is to outsource many of the more time consuming and labor intensive processes. One of the most strategic options is to consider outsourcing your payroll management functions.

A professional agency such a Accuchex can provide much-needed help with Human Resources needs and questions. Accuchex is a full spectrum Payroll Management Services provider offering expertise in Time Management, Insurance and Retirement issues, as well.

If you are looking for reliable resource for your HR issues, we can help. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision, or call Accuchex Payroll Management Services at 877-422-2824.

In addition, we invite you to take a tour of Time2Pay - it makes payroll easy: