The fate of the Department of Labor's Final Rule is still to be determined. The problem for employers is how to prepare now?

The Trump administration recently indicated that it was not favorable towards allowing former President Obama's expanded update of federal overtime pay rules. This was underscored by a court filing indicating that it may withdraw a White House appeal of a federal court's recent invalidation of the so-called Final Rule.

In November 2016, a U.S. District Court in Texas issued a nationwide preliminary injunction blocking the Department of Labor’s (DOL’s) Final Rule. The Rule sought to raise the required salary level to qualify for Exempt status. That ruling has since been appealed by the DOL.

A final decision by the appeals court is not expected until later this year.

President Trump's first choice to head the Labor Department, Andrew Puzder, had led many observers to believe that it is highly unlikely the administration will support the rule. Puzder, as well as many other high profile figures, have been highly critical of the Obama administration's labor agenda.

In fact, a number of business groups, several states, many lawmakers have all criticized the rule since it's announcement in May 2016. The doubling of the salary threshold for determining worker's overtime eligibility was just one of their stated concerns. It is expected that this increase would inevitably increase payroll costs and put pressure on many employers to simply cut jobs.

Another concern is that by setting the threshold too high, the DOL was making it impossible for employers and employees to set flexible work schedules. In addition, before the Final Rule was put on a judicial "hold" many businesses had already made changes to their pay structures in order to comply with the new rule.

Exempt Vs. Nonexempt: Some Things Remain the Same

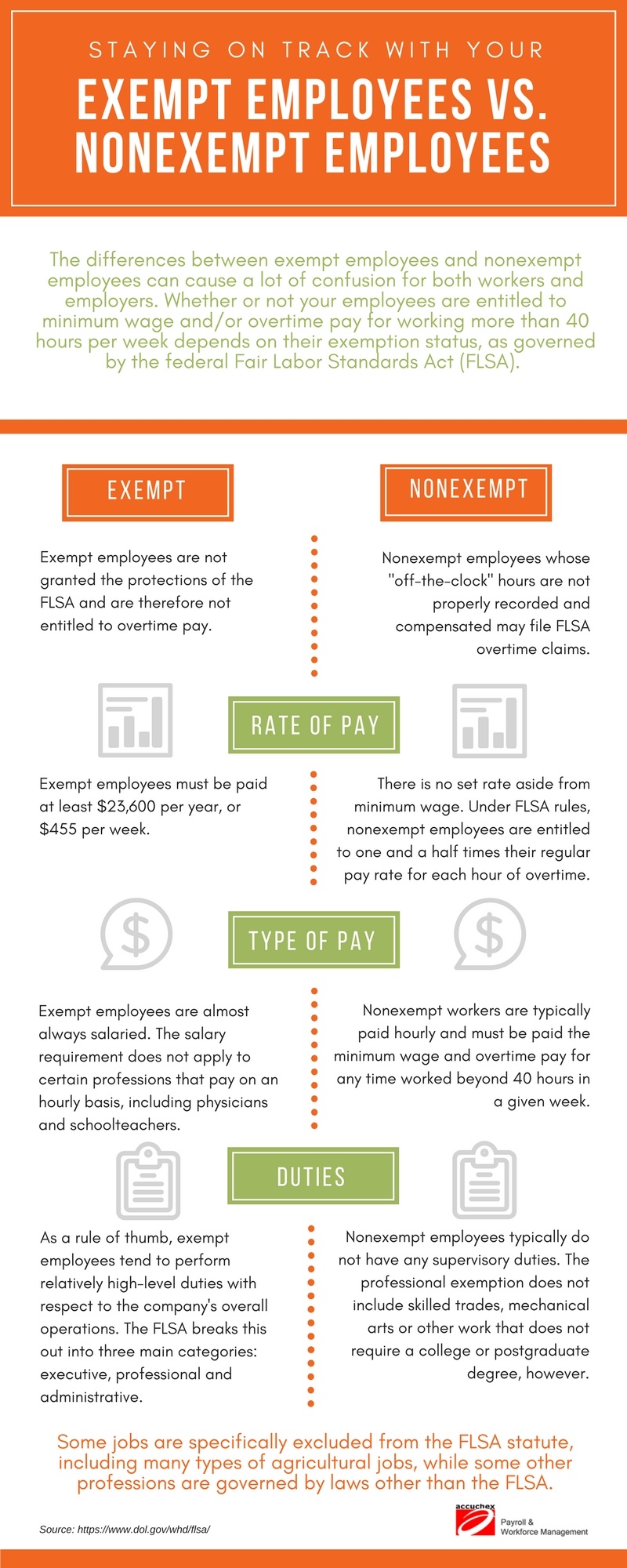

Until a final decision is made on the fate of the Final Rule, the "old" rule still applies. This subject has been confusing for many employers and continues to be so. Here is a infographic that highlights the keys distinctions for determining Exempt or Nonexempt employees on your payroll.

Share this Image On Your Site

Employers, Overtime, and the Final Rule

While the future of the Final Rule remains uncertain, there are still pressing issues that employers need to address. As noted earlier, many employers opted for a proactive course and made significant changes in their pay structure in anticipation of changes going into effect last year.

Uncertainty around what will happen next and how to prepare for that has created a level of anxiety for many employers. There are a few of the key concerns regarding the impact of the issuance of the Final Rule.

Many businesses have already taken steps to identify workers affected by the proposed new regulations. In many cases, they have already made classification changes and communicated those changes to their employees. As a result, it may be far too difficult to reverse those actions. If these employers have already authorized changes in their payroll they may find it to be less continue with those decisions, even should the Final Rule be overturned.

Even if the Final Rule is not upheld, as seems likely, employers are still subject to the existing FLSA exempt requirements for proper job classification and payment methods. All employers should evaluate the exempt status of their employees. By reviewing all employee's job duties and descriptions, owners and managers can ensure that their employees are properly classified in accordance with current FLSA requirements.

There is a possibility that the court may decide for the DOL. In that case, there is also the possibility that new regulations could be reinstated retroactively to the original effective date of December 1, 2016. Because of this possible scenario, employers should strive to track the actual time of their current employees that would be impacted by the implementation of the Final Rule. This would help ensure that businesses will have an accurate record of the hours affected Exempt employees worked.

Keeping Up With Labor Laws

Many new regulations expand the potential of risk for employers, require new workplace postings, or mandate changes to existing workplace policies. We recommend that all employers consult with experienced employment counsel to ensure compliance.

Accurate and timely management and compliance practices are required for every business and every payroll professional. But there are options.

Accuchex, a reputable payroll management services provider, can not only relieve you of the burden of your ongoing payroll process demands, but can potentially prove to be a more cost-effective solution, as well.

Click this link o get your free download of our Payroll Outsourcing Guide. Or click the button below to learn what you need to know about labor law in California. For more information, feel free to call Accuchex Payroll Management Services at 877-422-2824.