The state of California passed legislation back in 2015 that set the state on a course to a $15 an hour minimum wage by 2022. And it is costing employers.

California labor law mandates that almost all employees must be paid the state minimum wage, although there are some exceptions. This is above that required by federal labor law.

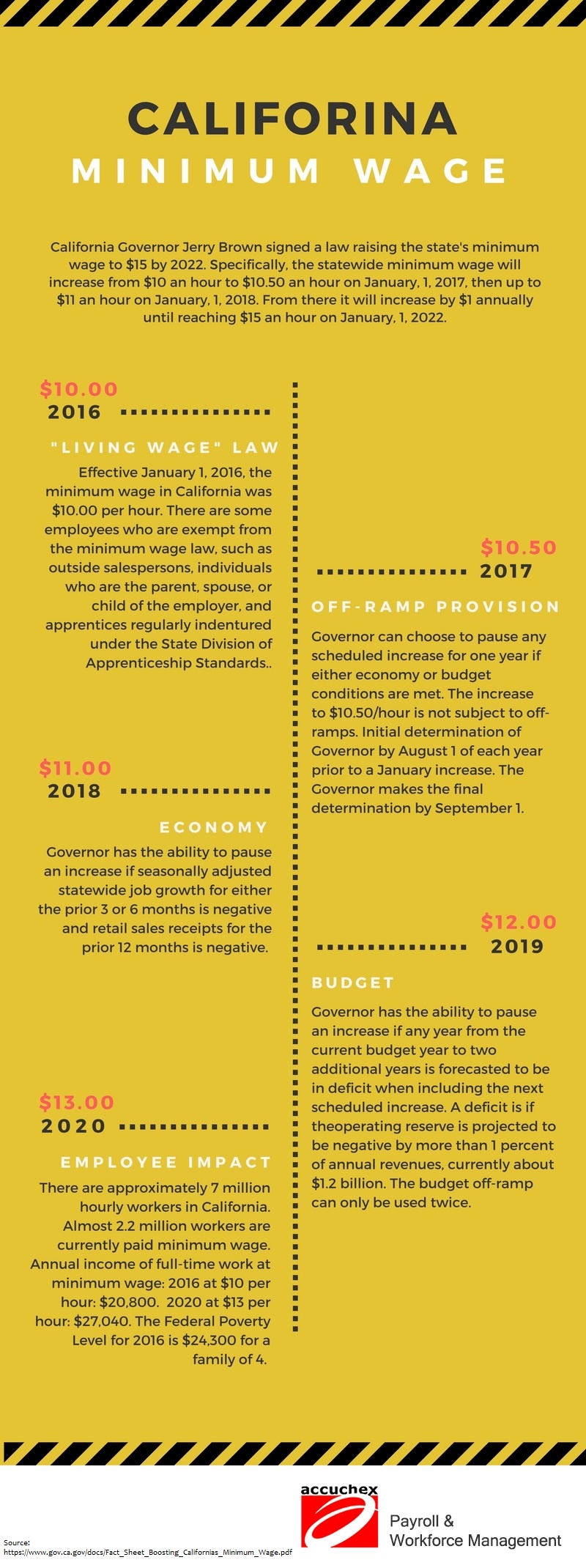

Beginning last January 1, 2016, the minimum wage in California increased to $10.00 per hour. As of January 1, 2017 it increased once more to $10.50 per hour.The mandated pay hike is currently for employers with 26 or more employees. However, this requirement will apply to employers with fewer than 26 employees beginning in 2018.

Cost to Employers

The estimated increase in just wage costs alone for California employers will be an immediate jump of almost 5% in addition to other pay increases needed to accommodate employees who were already earning close to what would now be the minimum amount.

The projections of the economic and business impact vary among experts, but it appears that the majority see many businesses struggling with the mandated overhead increases. It has been projected by one think tank group that because of the new wage requirement of $15-an-hour minimum, California is projected to lose out on 65,000 jobs.

The estimates are based on one minimum wage study, published in 2013. In addition, these results are just for the increases taking place in 2017, not the subsequent increases scheduled for future years. Even though some studies find little or no job effects, a 2014 analysis from the Congressional Budget Office (CBO) concluded that raising the federal minimum wage, for example, would likely cause significant job losses.

According to a recent article at qz.com,

By the end of the year, Wendy’s says it will have installed self-serve ordering kiosks in 1,000 of its restaurants.

COO Robert Wright told the LA Times that the machines, along with other forays into automation, will help reduce labor costs, which rose 5% at the company last year as a number of states—including Alaska, California, and Massachusetts—raised their minimum wages. Replacing human labor with machines, or threatening to do so, has become a common response to raising wages by fast food executives.

Employee Exceptions

The California wage labor law states that some employees are exempt from the minimum wage requirement. This includes outside salespersons, individuals who are the parent, spouse, or child of the employer, and apprentices regularly indentured under the State Division of Apprenticeship Standards.

Although the base minimum wage rate is established by the federal government, many states, including California, currently have minimum wage requirements that are far higher than the federal rate. The last federal increase went into effect back in July 2015, when the federal government mandated a nationwide minimum wage level of $7.25 per hour.

California currently has the third highest minimum wage in the nation, just below Washington and Massachusetts. Here is a snapshot of the projected increases for California:

California Cities and Counties Also Increased Minimum Wage

Since the end of 2016, at least 28 cities, towns or municipalities in California have established their own minimum wage laws and ordinances. This also includes the Jackson Rancheria Band of Miwok Indians Casino's and Resorts, which established it's own minimum wage requirements.

In addition, local minimum wage increases have been established in all of Los Angeles City and County, San Francisco, Oakland, Berkeley, Santa Clara, San Jose and Sacramento. Almost all of these cities, towns and counties are on similar tracks to eventually require at least $15 minimum wage rates. Many will be higher.

Navigating Minimum Wage and Other Labor Law Requirements

New regulations often increase both the costs and the risks for employers, requiring new workplace postings or changes to existing workplace policies. It is recommended that all employers consult with experienced employment counsel to ensure compliance.

In addition, new management and compliance practices are required for every business and every payroll professional. All of this can become burdensome and time consuming. But there are options.

Accuchex, a reputable payroll management services provider, can not only relieve you of the burden of your ongoing payroll process demands, but can potentially prove to be a more cost-effective solution, as well.

Call Accuchex Payroll Management Services at 877-422-2824 to get your free Payroll Outsourcing Guide, or click the button below and let us help you make an informed decision about our payroll solutions.