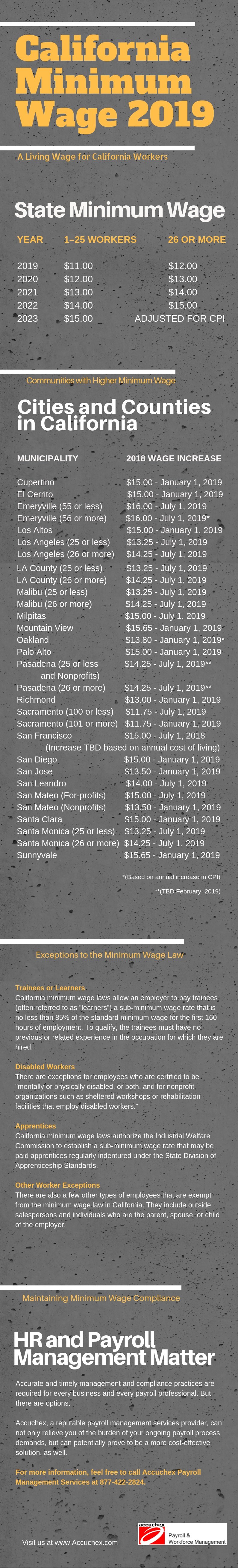

The state of California and a large number of counties and cities will see increases in their respective minimum wage requirements on January 1, 2019 as well as on July 1, 2019 for others.

The state of California's minimum wage for 2018 was set at $11.00 per hour for businesses with 26 or more workers. For those companies with 25 or less workers, the minimum wage in California was $10.50 for 2018.

Most Minimum Wage Changes Take Place on Tuesday, January 1, 2019

Those hourly wage amounts will increase to $12.00 and $11.00 consecutively. This increase will once again represent a significant annual increase in annual payroll costs for many small business owners. For those employers with 20 full-time minimum wage workers, for example, this adds up to about $20,800 in increased payroll costs, not including increased employment taxes and other associated costs

In the California Bay Area and in the greater Los Angeles region, there are over two dozen cities and counties that will see minimum wage increases above the state level. These, too, will take place in 2019, either on January 1, 2019 or on July 1, 2019.

The following infographic provides a fairly comprehensive overview of the upcoming minimum wage increases for 2019:

The state of California, unlike the federal government, does not allow employers to pay less-than-minimum wages to individuals classified as Non-Trainee Learners, Student Learners or Student Workers. In fact, all California employers must pay these workers the mandated minimum wage rate, unless otherwise exempt.

In addition, California is one of several states that pays tipped employees the state minimum wage and this is the rate California employers must abide by. Under the federal rules, tipped employees can be paid a much lower minimum wage

Compliance With Minimum Wage Laws

New regulations, such as minimum wage requirements, often increase both the costs and the risks for employers, requiring new workplace postings or changes to existing workplace policies. Because of this, it is recommended that all employers consult with experienced employment counsel to ensure payroll compliance. If you have any additional questions about minimum wage, check out our California Minimum Wage page for everything you need to know.

In addition, new management and compliance practices are required for every HR and every payroll professional. All of this can become burdensome and time consuming. But there are options.

Accuchex, a reputable payroll and workforce management services provider, can not only relieve you of the burden of your ongoing payroll process demands, but can potentially provide other cost-effective solutions, as well.

Call Accuchex Payroll and Workforce Management Services at 877-422-2824 to get your free Payroll Outsourcing Guide, or click the button below and let us help you learn more about our services.