We often hear that individuals and consumers need to be vigilant in protecting their identity, especially online. What we may not hear is that identity theft in the workplace is on the rise, as well.

According to one article on the AARP website, in 2013 more than 13 million Americans were victims of identity fraud. And, in 2015, more than 100,000 complaints were filed with the Federal Trade Commission (FTC) just in the state of New York alone, with many of these involving identity theft.

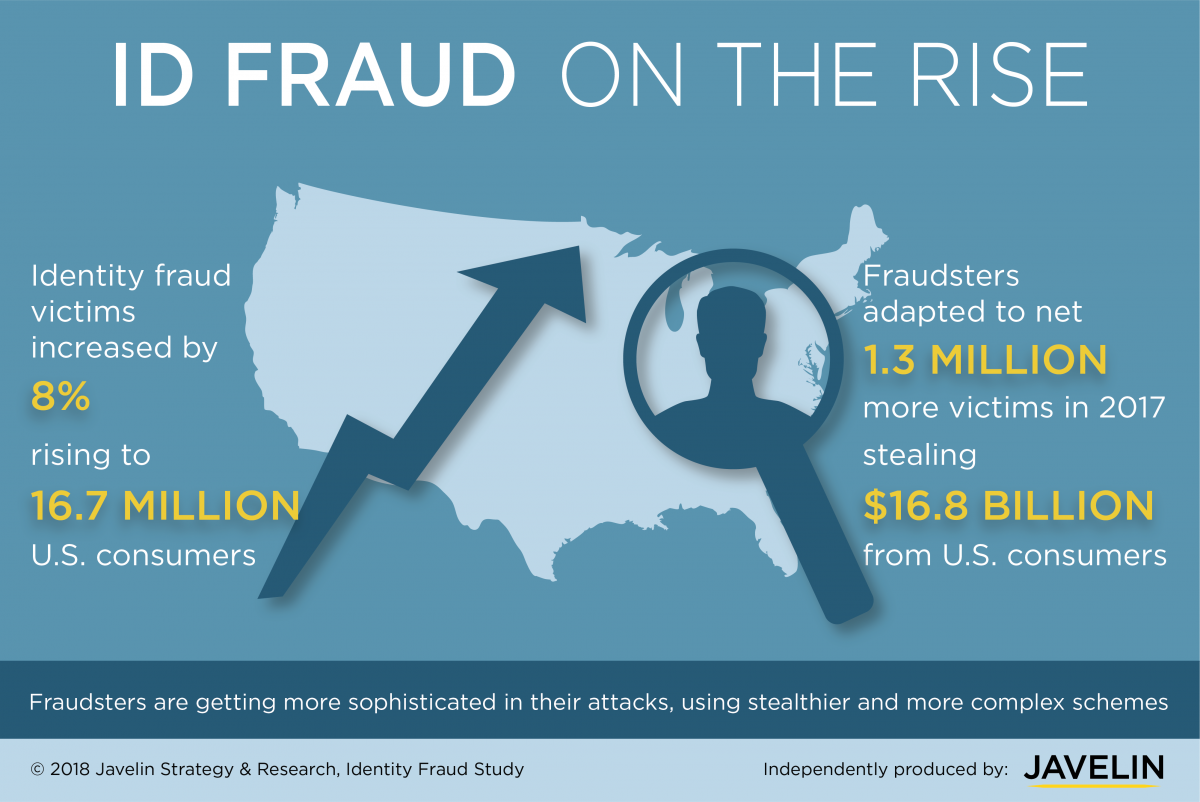

According to Javelin Strategy & Research, an estimated 15.4 million consumers were victims of some form of ID theft in 2016, which was 2.3 million more than the previous year.

And Experian noted in a recent blog post that,

The Identity Theft Resource Center (ITRC) recently announced its 2017 Data Breach report and it’s no surprise that breaches are up. Last year there were 1,579 data breaches exposing nearly 179 million records. That represents a 44% increase in the number of breaches and a 389% increase in records exposed.

We try to be safe. We change our passwords and hide our PIN numbers. We only shop online with reputable companies. Yet, too many of us undo all these precautions with the things we simply toss into the trash every day.

One of the biggest culprits is our mail. This can be what we think of as "junk mail" - those direct mail pieces that most of us tend to just throw out. But many of us also throw out old personal mail, paid bills that have been filed for a while, and many other items that may offer up a critical piece of personal information for the bad guys.

In the workplace, identity theft can occur despite what may seem to be more than reasonable precautions.

According to a post on the SHRM website:

"For employers, a primary source of exposure can be the theft or release of personnel records," said Kristin Story, an attorney with Lewis Roca Rothgerber Christie in Phoenix. These records can contain personally identifiable information, such as Social Security numbers, birth dates, bank account information, and sometimes health or other biometric information for employees and their relatives. Furthermore, employers may collect substantial personal information from employees and applicants to conduct background investigations and credit checks.

The reality is that not all identity theft is committed online. At least, not initially. And best prevention practices for homeowners and consumers can be just as effective in the workplace.

For example this post at earth911.com offers great advice for consumers that applies equally well in and office environment:

Think about all the mail you receive with financial information: bills, tax documents and even credit card solicitations. You are likely recycling this alongside your newspaper, magazines and cardboard boxes.

The easiest way to prevent identity theft when recycling mail is to shred these documents. The problem is that shredding significantly reduces the value of the paper fiber, meaning some recyclers won’t accept shredded paper. Here are a few other ways to safely recycle mail with personal information:

1. See if your community hosts a shredding event, where you can bring documents to be destroyed and recycled. In these cases, the recycling partner is able to process shredded paper.2. Use a marker to black out your personal information, including names and numbers.

Workplace mail is not the only material that is prone to theft. Other items that are commonly thrown into the office trash can compromise employee's identity security.

For example, identity thieves also target W-2 forms. One scam that has become common involves forged e-mails sent to a company's HR staff member. These emails appear to be from a company executive and often ask the staff member to send a copy of some (or all) of their employee W-2s.

If the impostor e-mail senders can obtain this information, they can then use the information to create and submit false tax returns or open lines of credit. And the company that released the information can be liable for the resulting identity theft.

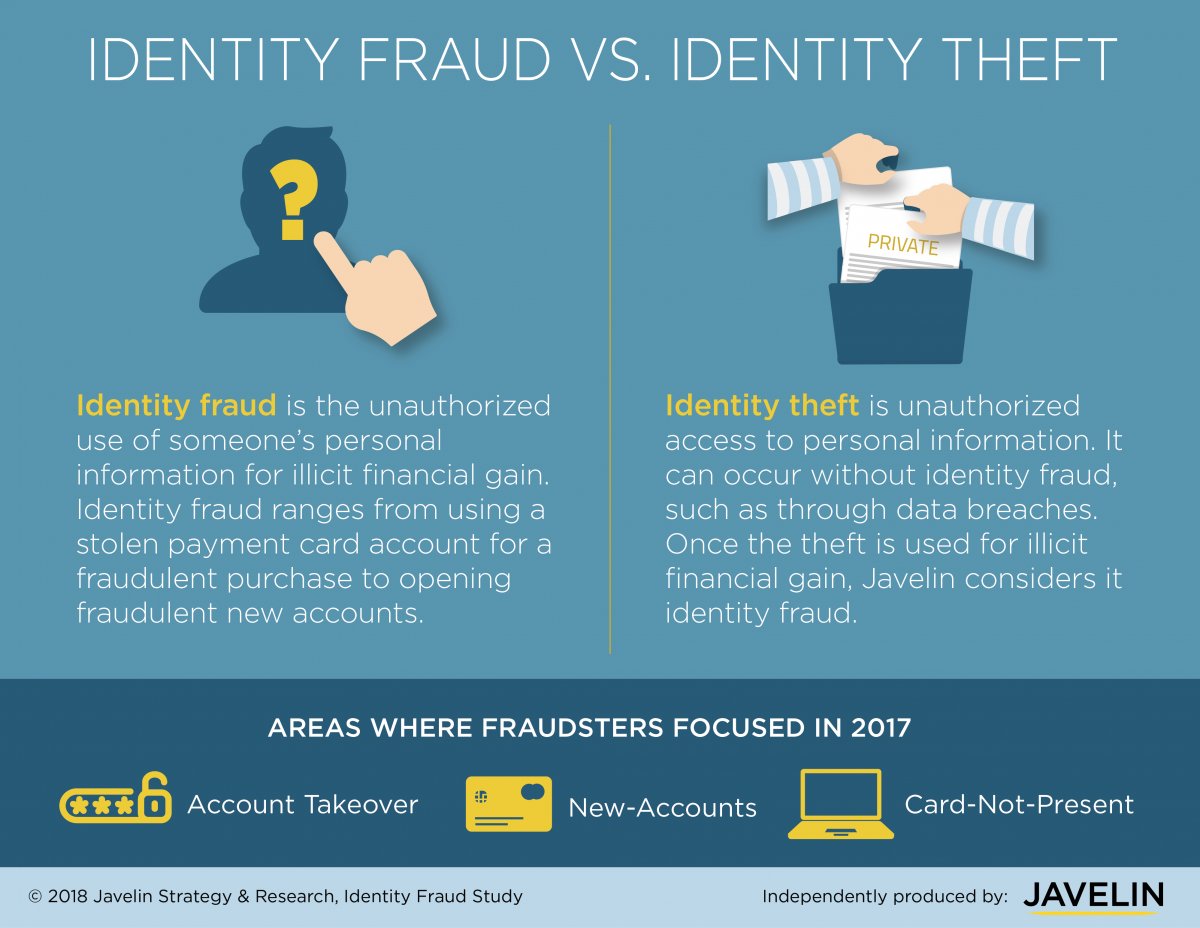

Identity Fraud vs. Identity Theft

Although we tend to use the terms interchangeably, they actually represent two distinct crimes. So, what's the difference?

[Courtesy of javelinstrategy.com]

Be Aware and Be Smart With Information

Although it's not as clean and easy as online phishing, digging through your business trash can allow determined identity thieves to piece together enough personal information to take the next steps. Ultimately, they can then use this information to open new accounts in someone else's name, make purchases online, or even steal one of your employee's identity entirely.

It is commonly believed that it's a crime to actually go through someone's trash. After all, until the waste management company takes it away, it would seem that it still belongs to the business it originated from. Unfortunately, this is not quite the case.

According to a recent U.S. Supreme Court, California vs. Greenwood , the court determined that the,

"expectation of privacy in trash left for collection in an area accessible to the public… is unreasonable.”

One of the best approaches is to be aware and to take precautions. If your office does not have shredders, your should make that a priority. Review anything you throw away before you toss it into the trash. Shred anything that might possibly be used by someone else.

In addition, employers should create, publish and enforce clear policies and procedures for the storage, use and access of personal information. Hard-copy records should be maintained in a secure location. Any information and records that are maintained electronically should have appropriate measures in place, such as password protection and data encryption, to ensure data security.

And be smart.

Cyber crime, identity theft, and identity fraud are not going away and are, instead, on the rise. But you don't have to let your workplace be an easy target.

Finding Help for Your Workforce Management Needs

In addition to a growing and demanding role in recruiting, hiring, and continually training employees, the HR staff is responsible for other functions they are typically tasked with such as payroll management, tax filings, employee records compliance, and so forth.

Considering alternatives such as outsourcing is increasingly becoming a cost-effective and strategic option. Accuchex can help you in managing your HR needs, payroll processes, and staying on top of compliance demands. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.