New Changes in the Affordable Care Act

Since 2015 there have been a number of major changes with the Affordable Care Act (ACA), such as the delay of the employer mandate and the Cadillac Tax, as well as the death of the automatic enrollment provision.

Other changes have not been anticipted, as well. According to a recent report in CNNMoney, for example:

UnitedHealthcare, the biggest health insurer in the United States, said that it plans to exit most of the Affordable Care Act state exchanges where it currently operates by 2017.

The health insurer had already indicated that it was dropping coverage of the plans, more commonly known as Obamacare, in Arkansas, Georgia and Michigan.

Hemsley explained that UnitedHealth will leave most states by 2017 because the markets for these exchanges are relatively small and also have higher risks for the company over the short-term.

It shouldn't come as a huge surprise. UnitedHealth had previously said that it lost $475 million on the ACA exchanges last year and could lose another $500 million this year.

2016 Changes for the Affordable Care Act

For 2016 the Affordable Care Act has recently undergone two minor health reform changes:

Affordability Threshold

The first change involves inflation adjustments for the so-called "affordability safe harbor percentages." According to the text of the ACA, the threshold for determining whether a health plan is “affordable” for an employee was “9.5% of household income.”

This means that the cost of that employee's coverage cannot exceed this amount. However, the law also provides for inflation adjustments to this threshold percentage.

The first adjustment began in 2016, increasing the 9.5% of household income threshold to 9.66%.

Increased Penalties

The ACA noncompliance penalties have been adjusted for inflation in the same way the safe harbor penalties. At the start of the ACA, applicable large employers (ALEs) that didn’t offer coverage to at least 95% of their full-time employees would be subject to a $2,000 per-employee penalty (minus the first 80 employees in 2015 and the first 30 employees thereafter).

In addition, employers that offered unaffordable coverage would be hit with a $3,000 per-employee penalty for each worker who obtained coverage on an exchange.

However, because of the inflation-based premium adjustment percentage, the IRS announced in Notice 2015-87 that the penalty amount would go up to $2,080 for the 2015 plan year and $2,160 in 2016.

The $3,000 per employee penalty also gets bumped up to $3,120 for 2015 plan year and $3,240 for 2016. This means that an employer with 100 FTE workers could be fined an additional $240 per employee for the 2016 plan year, and for 70 of those employees as opposed to only 20, as before. That's a potential penalty cost of over $19,000 for that employer.

Reviewing the Basics of the ACA Employer Compliance

The IRS issued employers a notice of the specific information they need to collect and report.

The IRS uses employers’ Section 6055 and 6056 reports to enforce the so-called “Play or Pay” mandate. Section 6055 requires sponsors of self-insured group health plans and insurance issuers to report on individual enrollments in minimum essential health coverage.

Section 6056 requires employers subject to the “Play or Pay” mandate to report on health coverage offered to full-time employees and their dependents, including information such as each full-time employee’s dollar share of the lowest cost monthly premium for self-only coverage.

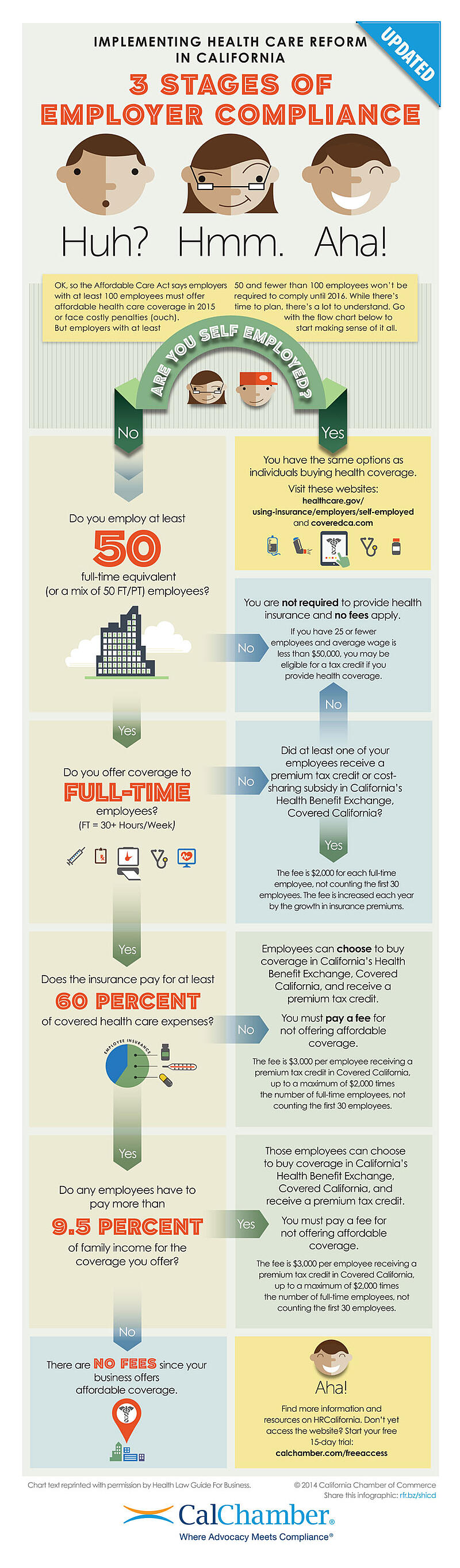

This infographic from CalChamber provides a flowchart for determining your employer compliance obligations:

ACA Compliance Steps You Should be Taking

Because of the complexity of the new information reporting requirements, McGladrey LLP advises that employers should take the following actions:

• Learn about the new information reporting requirements and review the IRS reporting forms.

• Develop procedures for determining and documenting each employee's full-time or part-time status by month.

• Develop procedures to collect information about offers of health coverage and health plan enrollment by month.

• Review ownership structures of related companies and engage professionals to perform a controlled/affiliated service group analysis.

• Discuss the reporting requirements with the health plan's insurer/third-party administrator and the company's payroll vendor to determine responsibility for data collection and form preparation.

• Ensure that systems are in place to collect the needed data for the reports.

Employers and HR Professionals Have Help for Navigating the ACA Requirements

An updated and streamlined reporting strategy will help your organization meet its obligations, while providing accuracy and timeliness. So take time to understand the law and prioritize accurate record keeping. In this way, you will make compliance a sure thing.

Another key step in maintaining HR compliance and increasing your company's cost-effectiveness is to consider outsourcing. A professional agency such a Accuchex can provide much-needed help with Human Resources needs and questions. Accuchex is a full spectrum Payroll Management Services provider offering expertise in Time Management, Insurance and Retirement issues, as well.