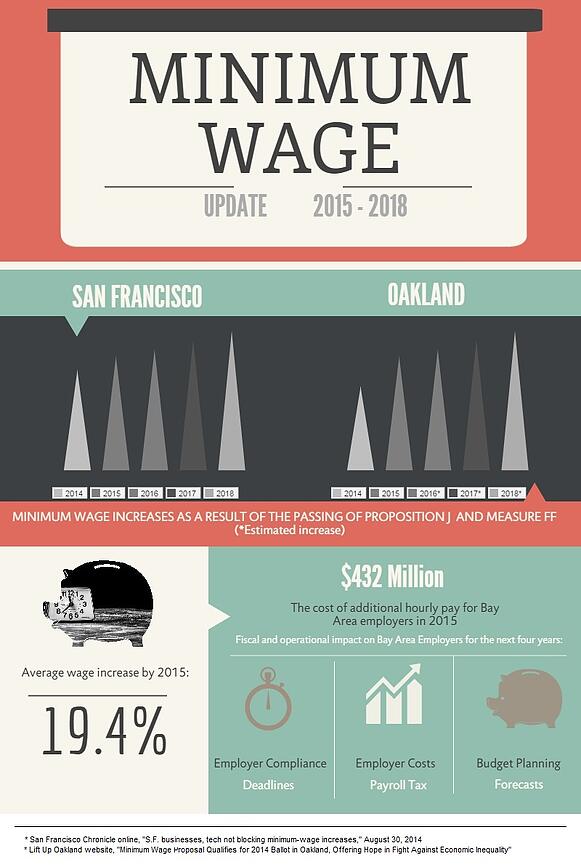

The results of the November 4, 2014 elections brought a number of legislative changes to Bay Area employers. For San Francisco and Oakland in particular, minimum wage law has been changed for 2015.

In San Francisco, the minimum wage will increase to $12.25 per hour in May 2015 from the current rate of $10.74 per hour. The new law will increase minimum wage again to $13 per hour in July 2016. From there, the wage will go up by one dollar every year until July 2018 when it tops out at $15 per hour.

This will make the annual pay for a minimum-wage employee, working full time, to $31,000 - an annual increase of over $8,800.

Voters approved a similar measure in Oakland to increase the citywide minimum wage to $12.25 beginning on March 2, 2015, from the current state level of $9.00. For employees in Oakland the minimum wage rate will see increases every year on January 1st based on cost of living adjustments.

Minimum Wage Law Impact on Employers

It is estimated that in San Francisco alone there will be over 142,000 minimum wage workers who will see a pay raise next May. In Oakland, this increase will not only come two months earlier, but it will be a greater percentage of an increase for the employers an estimated 40,000 to 48,000 workers.

This infographic provides some highlights of the impact of new minimum wage law increases:

While many of the actual totals are based on estimates, the total increased cost for San Francisco and Oakland city employers could top $432,000,000 in hourly wages just for 2015. This does not take into account increased payroll and employment taxes.

Administrative and compliance requirements are also an issue for these employers as wage increases will come into effect every July beginning in 2016 for San Francisco, and every January 1st in Oakland.

Getting Help From Professionals

Now is a great time to consider the advantages of outsourcing your payroll management functions to a professional agency. Accuchex is a full-featured payroll management service provider and offers a variety of support and resources.

Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.