Navigating the FUTA Credit Reductions

Navigating the FUTA Credit Reductions

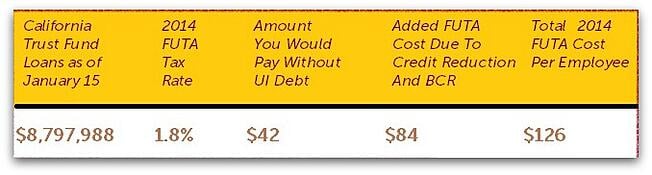

Normally, the standard Federal Unemployment Tax Act (FUTA) rate for employers is 6 percent on the first $7,000 of covered wages. And employers generally receive a FUTA credit reduction of 5.4 percent for any state unemployment insurance (UI) taxes they must pay. This reduces the FUTA rate for most of these employers to 0.6 percent of the wages paid - up to a limit of $7,000 per worker - or $42 per employee per year.

The problem for California employers is that California, as well as a number of other states, have outstanding federal UI loan balances. This means they are subject to reduced tax credits, resulting in higher FUTA taxes for employers in those states.

This has already impacted employers in California, Connecticut, Indiana, Kentucky, New York, North Carolina, Ohio and the Virgin Islands when the Department of Labor imposed an increased FUTA tax rate in January this year based on the FUTA taxable wages paid during 2014.

Employers paying the price?

The reason for the credit reduction penalty is that federal law discourages states from carrying their UI loan balances over several years. This penalty is imposed by further reducing the FUTA credit beginning in the fifth year of the loan.

This penalty is referred to as the Benefit Cost Rate (BCR). The BCR that was triggered for this year applied to all of the borrowing states (except Delaware) which began borrowing in fiscal year 2008-2009. The BCR penalty may be waived if a state’s governor submits an application to the US Secretary of Labor no later July 1st of the penalty year and the state takes no action (i.e. legislative, judicial, or administrative action) that would reduce UI trust fund solvency.

However, even if the BCR add-on is waived, and it normally is if the conditions are met, another penalty, referred to as the 2.7 add-on, can be imposed if that state’s average UI tax rate is inadequate. This penalty rate cannot be avoided or waived if triggered.

What's the score?

So far, all states that requested a waiver of the BCR add-on for 2014 were found eligible for the waiver. Connecticut did not request the BCR waiver, and as a result, employers in this state will have 0.5% added to their FUTA rate (in addition to the normal 1.2% credit reduction), for a total FUTA rate of 2.3%.

No state for tax year 2014 faces the special 2.7 add-on for having an average state UI rate that is lower than allowed under federal law.

Potential FUTA Credit Reduction 2015

The ongoing UI loan balance issue will continue to cost California employers an increasing amount due to the graduated increases in the percentage of the credit reduction. Looking ahead to tax year 2015, it is safe to say that, unless California's outstanding advance is not repaid by November 10, 2015 employers will see an additional 0.3% reduction in their FUTA credit.

This means the credit reduction amount will be at least 1.5% instead of the previous 1.2% penalty. That's $1,050 per employee per year. In addition, it is possible that an estimated BCR add-on of 1.4% could be applied. And while a request for a waiver would probably be applied for, it is possible for the Federal government to refuse to grant the waiver.

If that were to occur, California employers would be looking at a total potential credit reduction of 2.9% next year. If an employer paid, say, $7,800 in FUTA credit reduction penalties per employee this year, that same employer would be looking at clost to $19,000 for next year!

Staying on top of payroll management

For payroll managers, keeping up to date with continually changing Federal and State regulations and new legislation is a never-ending task. While some things, such as FUTA credit reductions, may be beyond your control, the consequences of mis-filing taxes, missing payments, or other withholding and tax filing errors can be costly for a business.

However, there are options to doing everything yourself.

If Accuchex is not currently filing your taxes, call to find out how we can smooth this process (and others) for your business. Let Accuchex help you in managing your HR needs, payroll processes, and staying on top of compliance demands. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.

Navigating the FUTA Credit Reductions

Navigating the FUTA Credit Reductions