California minimum wage for the state is already significantly higher than the federal level and one of the highest in the nation. And, increasingly, the minimum wage in California cities is even higher.

As California employers know, the minimum wage in California increased to $10.00 per hour on January 1, 2016. The minimum increased once again on January 1, 2017 to $10.50 . Currently, this labor law applies to employers with 26 or more employees. Those with 25 workers or less must pay a minimum wage of $10.00 per hour.

Until next January 1st.

Beginning in 2018, businesses with more than 25 employees are looking at paying $11.00 an hour minimum, and those with fewer than 26 employees having to pay $10.50. This minimum wage increase plan is only in it's second year and employers are noticing the effect.

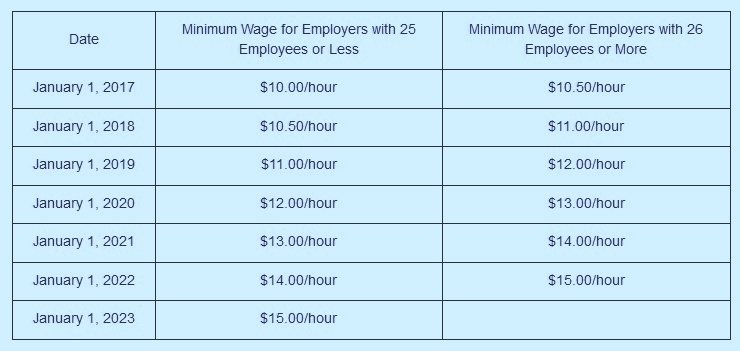

Here is a breakdown of the state of California Minimum Wage schedule:

In addition to the state mandated minimum wage, a number of cities, counties and other areas have instituted their own minimum wage requirements over the last few years.

Upcoming Increases for Minimum Wage in California Municipalities

In Emeryville, the minimum wage increases on July 1, 2017. For employers with 55 or fewer workers this will be $14.00 an hour. For large businesses with 56 or more employees, it will be $15.20 hourly. In San Francisco, the minimum wage increases to $14.00 for all employers on the same day.

July 1, 2017 also marks a minimum wage pay increase in Santa Monica to $12.00 an hour. In the city of Los Angeles and for Los Angeles County, employers with less that 26 employees will pay $10.50, but those with 26 or more must begin paying $12.00 an hour minimum wage. This, too, will occur on July 1, 2017.

Pasadena will mirror Los Angeles with the same pay increases except that it will apply to all employers, also on July 1st.

For many of these cities, the increases will "cap out" in three to five years, with periodic increases based on the Consumer Price Index, as needed. In addition, on the state level, the current legislation allows the governor to pause increases for a year if there are relevant budget or economic factors.

Dozens of California Locales Have Increased Their Minimum Wage

At least 28 counties, cities, towns and municipalities in California have established their own minimum wage laws and ordinances since 2016. And indications are that a number of other cities are considering following suit.

Along with these are the Jackson Rancheria Band of Miwok Indians Casino's and Resorts, which established their own minimum wage requirements.

A partial list of local minimum wage increases includes all of Los Angeles City and County, San Francisco, Oakland, Berkeley, Santa Clara, San Jose and Sacramento. Almost all of these cities, towns and counties are on similar tracks to eventually require at least $15 minimum wage rates. Many will be higher.

Economic Impact for Employers and Workers

Lower income workers, for whom the mandatory wage increase was intended to benefit, often suffer as a consequence from unintended effects.

According to one study, when California implemented a 10-percent minimum-wage increase, there was a corresponding 1.2 percent decline in new low-wage workers. This seemed to indicate that while, existing workers kept their jobs and benefited from the increased pay, fewer minimum-wage jobs were being created or filled.

And for small business owners, the financial impact has been very immediate. This is especially true for restaurant owners and their employees who are typically minimum wage earners.

California has the largest restaurant industry in the country, and accounts for almost 4 percent of the United States’ total gross domestic product. In addition, the state also has one of the highest proportions of non-white restaurant workers with Latinos comprising over 50 percent of California’s restaurant workforce as recently as 2015.

Compliance With Minimum Wage Requirements

New regulations often increase both the costs and the risks for employers, requiring new workplace postings or changes to existing workplace policies. It is recommended that all employers consult with experienced employment counsel to ensure compliance.

In addition, new management and compliance practices are required for every HR and every payroll professional. All of this can become burdensome and time consuming. But there are options.

Accuchex, a reputable payroll and workforce management services provider, can not only relieve you of the burden of your ongoing payroll process demands, but can potentially provide other cost-effective solutions, as well.

Call Accuchex Payroll and Workforce Management Services at 877-422-2824 to get your free Payroll Outsourcing Guide, or click the button below and let us help you learn more about your labor law compliance needs.