Clarifying the status of certain employees has always been a challenge for employers. And the importance of proper classification for independent contractors cannot be over emphasized.

Today's world of recruiting and hiring has become increasingly complex. HR managers and business owners must navigate through a number of compliance requirements regarding employee classification.

What may seem to be a simple matter of calling one worker an independent contractor versus an employee has become increasingly tricky and potentially costly for businesses.

Employee classification is not simply a matter of assigning a designation to a worker. According the the CalChamber website,

Using a true independent contractor can relieve you of the many burdens placed upon you by California and federal employment laws, but simply calling someone an independent contractor does not make him or her one in the legal sense.

Incorrectly classifying employees as independent contractors is a real risk for many employers. An article from Forbes.com noted that,

This fundamental worker status issue has become one of the most consequential legal determinations around. If you’re in business and guess wrong, the liability for past years can be crushing.

A recent report by the IRS Inspector General noted that many employers are still making costly errors when it comes to employee classification.

Why Classifying Employees Correctly Matters

Mis-classifying employees can result in significant liability. According to a article from HRCalifornia,

If your company controls the details and the worker does not have meaningful discretion in how he/she completes the work, it has generally been the rule that the worker will be found to be an employee and not an independent contractor.

In addition, state governments and the IRS are concerned about the loss of tax revenue when this occurs. According to a statement by J. Russell George, Treasury Inspector General for Tax Administration,

This problem adversely affects employees because the employer’s share of taxes is not paid and the employee’s share is not withheld. If left unchecked, the problem will continue to deprive the Federal Government, and the American people, of millions of dollars in lost revenue every year.

There Are Defined Guidelines for Proper Employee Classification

The IRS has, historically, provided guidelines to direct its agents on how to determine worker status. These guidelines include a list of 20 factors determined by the IRS and have been used in court decisions regarding worker status.

These are still used as guidelines and commonly referred to as the "20-factor test." However, some of the factors are less relevant today as they had been in the past. Currently, IRS agents are directed to focus on the overall situation rather than specific aspects of the 20 factor test.

According to the IRS rules, employee classification and a worker's status hinges on whether the employer has the right to direct and control the service provider on what is to be done and how it is to be done. Typically, an employer does control how an employee performs work. On the other hand, independent contractors will usually determine how their work is done.

Three issues to consider

Legal precedence and recent court cases have established three broad categories of factors for determining employee classification:

1. Behavioral control

Do you, as the employer, have a right to direct and control how the worker does the task that you hired them for? Behavioral control factors include the extent of:

- Instructions you or your staff gives the worker. Normally, an employee is required to follow instructions regarding how, where, and when, he or she works. (Note that even if there are no explicit instructions provided, it can be deemed that sufficient behavioral control may exist you have the right to control how the worker's results are achieved.)

- Any training your company provides the worker. While independent contractors normally implement their own methods, employees are often trained to perform their job by the employer.

2. Financial control

Does your business have a right to control the business aspects of the worker’s job such as:

- The extent of un-reimbursed business expenses incurred. Independent contractors are likely to have un-reimbursed expenses whereas employees do not. Especially important are the fixed, ongoing costs that can be incurred regardless of whether or not the work is being performed.

- The extent to which a profit can be realized or a loss incurred by the worker. An independent contractor, unlike most employees, can make a profit or loss.

- The extent to which the worker has an investment in facilities, tools, or equipment. Independent contractors normally have a significant investment in what they need to perform services for someone else.

3. Relationship between parties

Relevant facts regarding the type of relationship between you and the worker include:

- A written contract defining the relationship intended between your company and the worker.

- Whether your business provides the worker with any benefits, such as health insurance, vacation pay or sick pay, or even pension plans. These are typically benefits reserved for employees.

While there may be many other factors to consider, these three provide the legal context for determining classification.

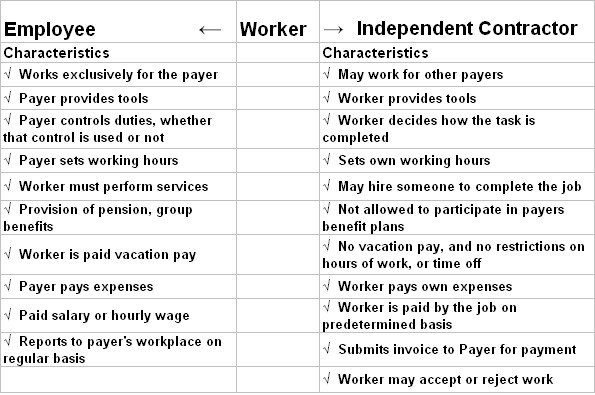

This chart illustrates the distinct factors that an employer needs to consider when classifying an employee:

In addition, the state of California has it's own rules regarding the classification of employees and independent contractors. The CalChamber website noted that,

California courts and administrative agencies have generally applied common law principles to determine independent contractor status, since the law does not specify criteria for such determinations.

The most important factor in that determination involves the independent contractor's right to control the manner and means of accomplishing the desired result, even if the contractor does not exercise that right with respect to all details.

The California Supreme Court discarded the common law test as the sole means of determining independent contractor status in relation to workers' compensation coverage. The court applied six additional factors federal authorities use as well as the right-to-control factor.

Therefore, this decision affects independent contractor status not only for workers' compensation purposes but for other employment-related claims as well. As a result, there has been a decrease in the number of independent contractor relationships upheld by the courts and administrative agencies.

Employee Classification: Getting It Right

With the recent pressure being put on employers by both the IRS and various state agencies, it is critical that businesses be fully informed regarding the correct status and proper employee classification of all their workers.

According to the IRS website:

"Businesses must weigh all these factors when determining whether a worker is an employee or independent contractor. Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor.

There is no “magic” or set number of factors that “makes” the worker an employee or an independent contractor, and no one factor stands alone in making this determination. Also, factors which are relevant in one situation may not be relevant in another.

The keys are to look at the entire relationship, consider the degree or extent of the right to direct and control, and finally, to document each of the factors used in coming up with the determination."

If you are looking for reliable help with determining employee classification, we can help. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.