California employers are going to once again be inundated with a new installment of labor laws. Most go into effect on January 1, 2017. Are you prepared?

By now, most business owners, employers, and HR managers have had a chance to acquaint themselves with the latest in California labor laws passed this year. However, many of these new regulations become effective in less than a week. With the new year just around the corner, time is short for getting prepared.

Another New Year, Another Series of New Legislation

Governor Brown and the California legislature did not produce quite as many new labor related laws in late 2016 as they have in previous years. Yet, there were still dozens passed and signed by the governor.

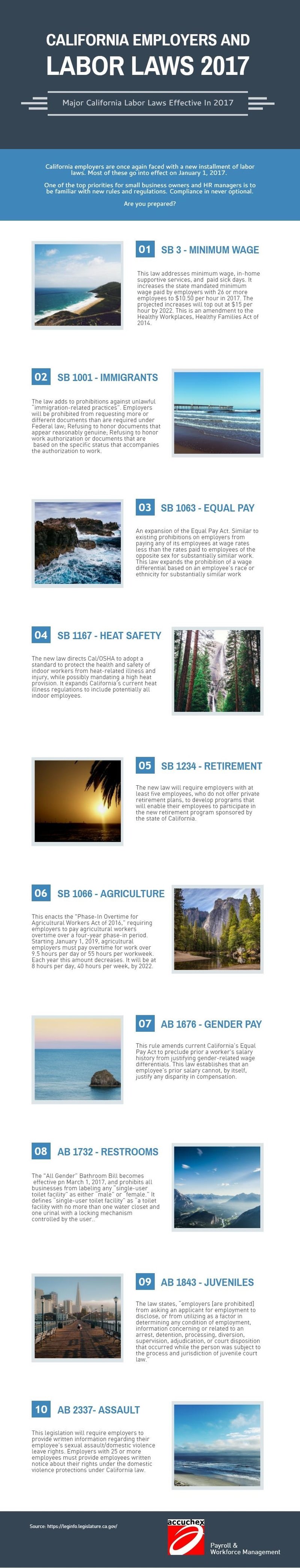

Of these, a number promise to impact most, if not all, employers in California. Here is a graphic which highlights 10 of these new laws coming out of Sacramento for 2017:

Share this Image On Your Site

In addition to these state-wide laws, there was other significant legislation passed that should be noted, as well.

California SB1241, for example, states that employees who work and live in the state of California cannot be required by their employers to enter into agreements that would put their claims in a forum in another state.

For businesses based outside of California, but who have facilities and employees in California, any legal dispute between an employee and that employer, must stay in California. In other words, SB1241 does not allow any adjudication or arbitration outside of California, for a claim arising in California. This, too, becomes effective on January 1, 2017.

One other piece of legislation that could prove somewhat costly to employers, is AB2899. This

law, which goes into effect January 1, provides that employers who are appealing a Labor Commission ruling for wage and hour violations must now post a bond that includes the assessed amount of unpaid wages.

The bond amount would be forfeited to the employee if the employer does not win the appeal and doesn't pay the amount owed within 10 days of the conclusion of the appeal process. of the case’s conclusion.

Staying Informed and Employer Due Diligence

Compliance by employers, especially with issues such as California sick leave law requirements, means having an ongoing and up-to-date process for tracking, understanding, and implementing the provisions of these laws.

There are a number of resources that can assist with this process such as CalChamber’s HRCalifornia site. A good payroll management services company that also provides Human Resources and Insurances services, such as Accuchex Payroll Management Services, is a great option to consider.

Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.