Payroll errors are annoying, but often tolerated. But the larger issues are usually the payroll management problems most business fail to resolve.

[This post has been revised and updated from June 2015]

Even with the abundance of software, tools, and resources there are still a number of typical common problems with payroll management that business struggle to address. If you are a payroll management professional or small business owner you are probably encountered all of these and many more.

And if your company is like most, you've little to no success in resolving them.

Diagnosing Your Payroll Management Process Problems

In a number of surveys most of the businesses polled stated that there is room for improvement in their payroll process. Accuracy and compliance are high-priority concerns for all businesses although not all take the steps needed to ensure these.

According to a survey by Deloitte Consulting only 63% of respondents reported having governance policies covering the payroll function. However, 81% of respondents conducted periodic reviews of their payroll process. All of which is great for payroll compliance maintaining a consistent payroll process.

What many businesses don't realize is that the real problems are a bit more holistic and operational. While up-to-date software can enable HR, payroll, and employee data to be less overwhelming, if storage and processes are not well organized,for example, you are open to errors.

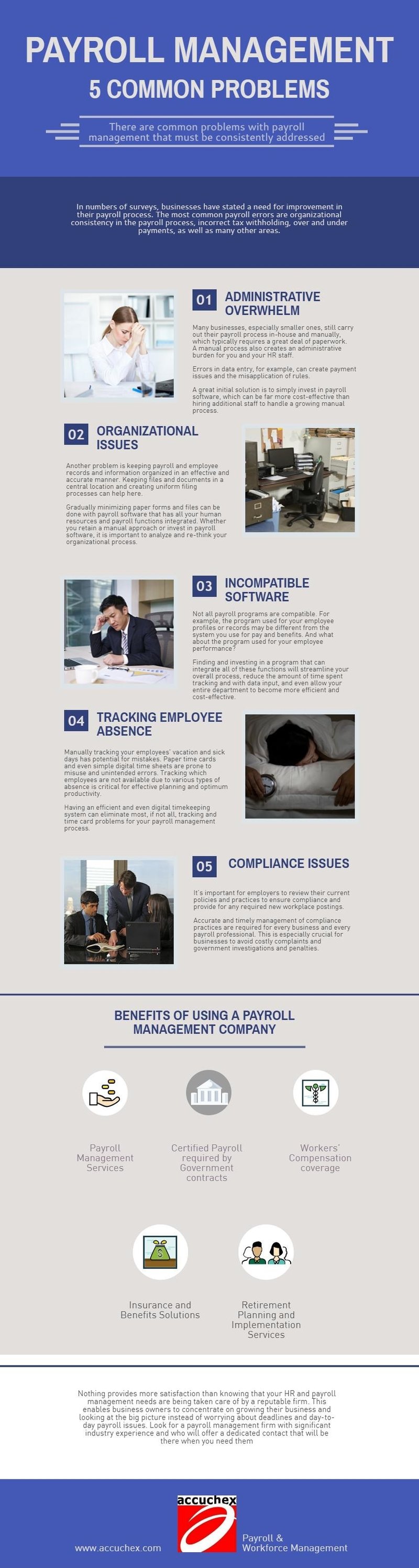

The most common payroll errors reported in surveys are organizational consistency in the payroll process, incorrect tax withholding, over and under payments, as well as many other areas.

And this can back up your payroll department back by several days.

Five Problems With Payroll Management

One of the realities of successful management is the need for effective systems, or processes. Without a comprehensive, consistent and repeatable process very little can be done reliably in a business. Despite the fact that your business is different from others and may have unique requirements, the essentials for most every process is essentially the same for any business.

Ideally, most every function in your payroll should be done the same way each time, every time, with the same results. These process, or procedures, should not vary unless or until new regulations or requirements dictate. Or if new technology is brought in to automate some of these functions.

With that in mind, here is a handy infographic that summarizes the five most common management problems for typical payroll processes.

Share this Image On Your Site

While there are undoubtedly a number of other issues that can be listed, here is an overview of the five most common problems with typical payroll management processes for companies doing payroll in-house, and some tips on how to resolve them:

1. Administrative Overwhelm

Many businesses, especially smaller ones, still carry out their payroll process in-house and manually. A manual payroll system typically requires a great deal of paperwork. A manual process also creates an administrative burden for your and your HR staff.

Errors in data entry, for example, can create payment issues and the misapplication of rules. This can resolved by using an integrated software. In fact, a great initial solution is to simply invest in payroll software, which can be far more cost-effective than hiring additional staff to handle a growing manual process.

Another approach that even smaller businesses can afford is to outsource your payroll management. This allows some or all of your payroll and HR processes to be managed by a professional firm.

2. Organizational Issues

A related problem is one of simply keeping all of your important payroll and employee records and information organized in an effective and accurate manner. Sometimes it is simply a matter of work flow: keeping files and documents in a central location and creating uniform filing processes.

Gradually minimizing, or even eliminating, paper forms and files can be an effective solution, This, too, can be accomplished by using a payroll software that has all your human resources and payroll functions integrated. But whether you retain a manual approach or invest in a robust payroll software package, it is important to analyze and re-think your organizational process.

3. Incompatible Software

If you haven't experienced it already, you may find that not all payroll programs are compatible. For example, the program used for your employee profiles or records may be different from the system you use for pay and benefits. And what about the program used for your employee performance?

Finding and investing in a program that can integrate all of these functions will streamline your overall process, reduce the amount of time spent tracking and with data input, and even allow your entire department to become more efficient and cost-effective.

4. Tracking Employee Absence

Manually tracking your employees' vacation and sick days can be a task fraught with potential for mistakes. Paper time cards and even simple digital time sheets are notoriously prone to misuse and unintended errors. In addition to the payroll, tracking which employees are not available due to various types of absence, is critical for effective planning and optimum productivity.

Having an efficient and even digital timekeeping system can eliminate most, if not all, tracking and time card problems for your payroll management process.

5. Compliance Issues

The California legislature recently passed a number of new laws and amended many others. Most of these changes already took effect on the first of January this year. As a result, it’s important for California employers to review their current policies and practices to ensure compliance and provide for any required new workplace postings.

Accurate and timely management of compliance practices are required for every business and every payroll professional.This is especially crucial for businesses to avoid costly complaints and government investigations and penalties.

Fortunately, outsourcing payroll can be a solution to mitigate this risk. A reputable payroll management services provider, can not only relieve you of the burden of your ongoing and changing compliance demands, but can potentially prove to be a more cost-effective solution, as well.

Payroll Management Outsourcing As a Solution

As a business owner or payroll manager you have a number of options for your payroll functions. Software that can be installed in-house, or cloud-based programs offer a good alternative. But if you really want to take full advantage of the benefits available to you, outsourcing to a provider like Accuchex can still be the best decision.

In addition to resolving the common problems in managing your payroll, you can include the peace of mind of knowing that your other HR processes are being handled competently, accurately, and on time. On top of that, you can be assured that the accountability and liability for compliance rests with your vendor, freeing you from the constant pressure of staying fully informed and compliant with the ever changing - and growing - rules, regulations, and legislation.

Reliability, full-service options, and reputation are the hallmarks of a quality payroll management service provider. If you are currently looking to invest in outsourcing you get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.