There are many payroll management solutions available to businesses. But when your company is small, or just starting out, having an effective foundation is essential.

[Payroll management is a fundamental aspect of business operations. This post has been revised and updated from an earlier post from June 2015]

Whether you are a new business just starting out, or looking to improve your current small business payroll process, there are a variety of options to consider. In addition, there are also a variety of tools and resources available to help you in designing - or re-designing - your payroll process.

According to Entrepreneur.com,

While the majority of U.S. businesses process paychecks internally, this is not always cost-effective. At minimum, internal payroll processing requires the purchase of a computer or manual accounting program and extensive training to use it. In addition, businesses need to keep up to date on changes in personnel, deadlines, and tax requirements on an ongoing basis.

Smaller Businesses Still Need Professional Payroll Management

It's important to run your payroll management process in a professional manner. Your employees are your most valuable asset and they deserve the best systems you can provide for them for payroll and to ensure a well-managed payroll process.

For the most part, smaller businesses with a stable, paid staff and minimal changes in tax obligations are often better off processing payroll internally. While this approach can be more convenient and efficient if your payroll process is basic, there is still the time spent managing the process. And, for that reason, many businesses determine that it is no longer inexpensive.

The reality is that payroll can be one of the greatest sources of frustration and costly errors and oversights for a small business. Not to mention the potential for litigation or penalization from government taxing agencies such the IRS.

Getting your payroll process right from the start, or re-structuring it now to ensure that it is functioning optimally, will be one of your most profitable investments.

So what are the basics that must be in place to ensure an effective payroll process in the first place?

Four Steps In Setting Up Your Small Business Payroll Success

Setting up and managing a payroll system does not have to be difficult. Any business owner or competent staffer can make this happen with a few guidelines and tools. The key is to get it set up properly from the start so that when your business grows and the number of employees expand, your payroll process is already on a good foundation.

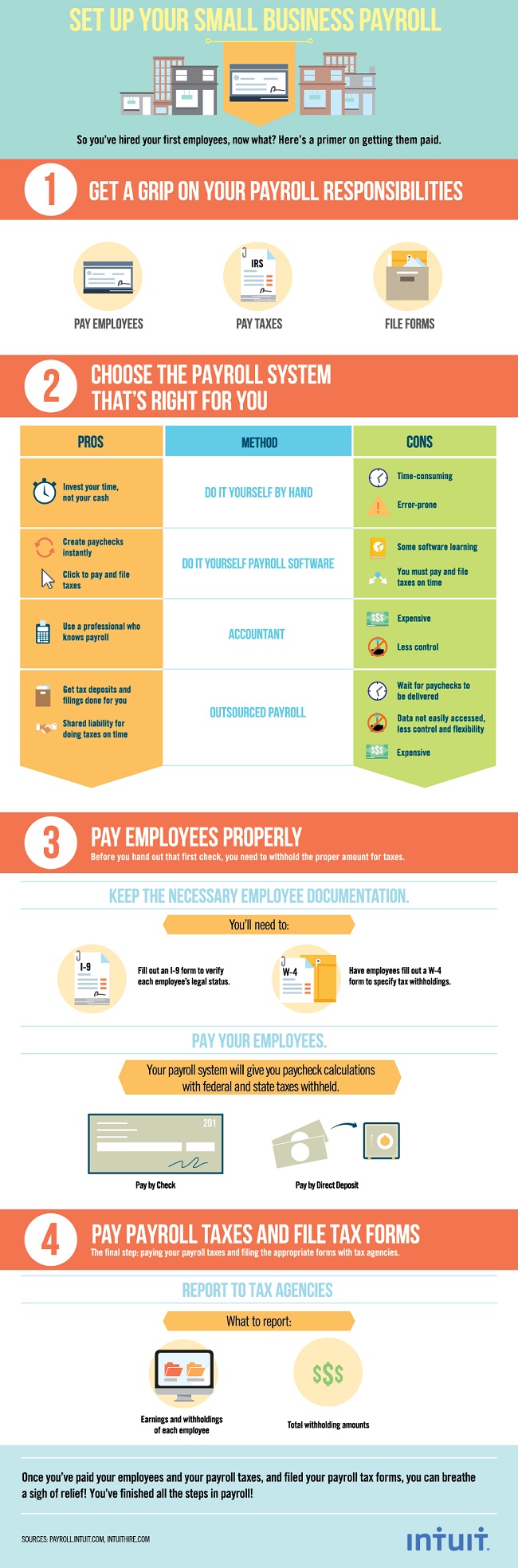

There four essential steps needed for setting up your payroll for small business:

(image courtesy of intuit)

(image courtesy of intuit)

5 Common Payroll Management Problems (And How to Resolve Them)

Here is an overview of the five problems with typical payroll management processes for companies doing payroll in-house. While there are undoubtedly a number of other issues that can be listed here, these are usually the most common . and here are some tips on how to resolve them, as well:

1. Administrative Overwhelm

Many businesses, especially smaller ones, still carry out their payroll process in-house and manually. A manual payroll system typically requires a great deal of paperwork. A manual process also creates an administrative burden for your and your HR staff.

Errors in data entry, for example, can create payment issues and the misapplication of rules. This can resolved by using an integrated software. In fact, a great initial solution is to simply invest in payroll software, which can be far more cost-effective than hiring additional staff to handle a growing manual process.

Another approach that even smaller businesses can afford is to outsource your payroll management. This allows some or all of your payroll and HR processes to be managed by a professional firm.

2. Organizational Issues

A related problem is one of simply keeping all of your important payroll and employee records and information organized in an effective and accurate manner. Sometimes it is simply a matter of work flow: keeping files and documents in a central location and creating uniform filing processes.

Gradually minimizing, or even eliminating, paper forms and files can be an effective solution, This, too, can be accomplished by using a payroll software that has all your human resources and payroll functions integrated. But whether you retain a manual approach or invest in a robust payroll software package, it is important to analyze and re-think your organizational process.

3. Incompatible Software

If you haven't experienced it already, you may find that not all payroll programs are compatible. For example, the program used for your employee profiles or records may be different from the system you use for pay and benefits. And what about the program used for your employee performance?

Finding and investing in a program that can integrate all of these functions will streamline your overall process, reduce the amount of time spent tracking and with data input, and even allow your entire department to become more efficient and cost-effective.

4. Tracking Employee Absence

Manually tracking your employees' vacation and sick days can be a task fraught with potential for mistakes. Paper time cards and even simple digital time sheets are notoriously prone to misuse and unintended errors. In addition to the payroll, tracking which employees are not available due to various types of absence, is critical for effective planning and optimum productivity.

Having an efficient and even digital timekeeping system can eliminate most, if not all, tracking and time card problems for your payroll management process.

5. Compliance Issues

The California legislature recently passed a number of new laws and amended many others. Most of these changes already took effect on the first of January this year. As a result, it’s important for California employers to review their current policies and practices to ensure compliance and provide for any required new workplace postings.

Accurate and timely management of compliance practices are required for every business and every payroll professional.This is especially crucial for businesses to avoid costly complaints and government investigations and penalties.

Fortunately, outsourcing payroll can be a solution to mitigate this risk. A reputable payroll management services provider, can not only relieve you of the burden of your ongoing and changing compliance demands, but can potentially prove to be a more cost-effective solution, as well.

Having An Efficient Small Business Payroll Process

Whether you commit to running and managing your own payroll process, or outsource some or all of it, knowing the basics is essential. One of the basics of building and running a successful business is knowing what to keep and what to outsource.

Although investing in the best possible in-house software systems for your payroll process is a viable option, another direction you might consider is outsourcing. And while this can be simply outsourcing one process such as your payroll, with a full-service provider such as Accuchex, you have additional options for outsourcing as well.

Let Accuchex help you in managing your HR needs, payroll processes, and staying on top of compliance demands. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.