Social Security Wage Base Remains the Same for 2016

Social Security Wage Base Remains the Same for 2016

On October 15, 2015 the Social Security Administration (SSA) announced that the 2016 social security wage base will be remain at $118,500, which is unchanged from 2015. Earnings above this amount are not subject to the Social Security portion of the payroll tax or used to calculate retirement payouts.

For HR professionals, this means that they will not have to adjust their payroll tax systems next year, since the amount of earned income subject to Social Security taxes will not be changing. The reason for this is the absence of inflation in recent months.

Social Security is financed by a 12.4 percent tax on wages up to the annual threshold, with half (6.2 percent) paid by workers and the other half paid by employers. This taxable wage base usually goes up each year—it rose from $117,000 in 2014 to $118,500 in 2015.

Typically, by January 1 each year, U.S. employers must adjust their payroll systems to account for the higher taxable wage base under the Social Security payroll tax, and notify highly compensated employees affected by the change that more of their paychecks will be subject to the tax.

This will not have to be done for 2016, however.

How the Social Security Cost of Living Adjustment is Determined

Any annual Social Security cost of living adjustment (COLA) is determined based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The CPI-W is a broad measure of consumer prices that is generated by the Bureau of Labor Statistics. The Social Security COLA is then calculated by comparing consumer prices for July, August and September of each year to prices for the same three months from the previous year.

According to J. Jioni Palmer, associate commissioner for external affairs at the SSA,

“Each year, Social Security calculates the automatic cost-of-living adjustment, if any, that our program beneficiaries will receive the following year. For years when there is a Social Security COLA, this adjustment is intended to keep inflation from eroding the purchasing power of Social Security and Supplemental Security Income benefits. Because the CPI-W has not increased, there will be no COLA for 2016.”

Palmer added that, “Since there is no COLA, the statute also prohibits a change in the maximum amount of earnings subject to the Social Security tax, as well as the retirement earnings test exempt amounts.”

The COLA amount is tied directly to inflation and the calculation is automatic. If inflation increases during the consumer price index measurement period, then the COLA amount is increased accordingly.

There will be no limit to the wages subject to the Medicare tax, which is a continuation from prior years. This means that all covered wages are still subject to the 1.45% tax. Wages paid in excess of $200,000 in 2016 will be subject to an extra 0.9% Medicare tax that will only be withheld from employees' wages. This is unchanged from 2015. Employers will not pay the extra tax.

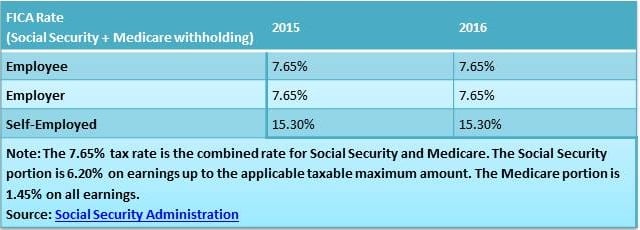

FICA Rates Set by Law

Social Security and Medicare payroll taxes are collected together as the Federal Insurance Contributions Act (FICA) tax. FICA tax rates are statutorily set, and therefore require new tax legislation to be changed.

For employees, the Medicare payroll tax rate is 1.45 percent on all earnings, bringing the combined Social Security and Medicare payroll tax for employees to 7.65 percent—with only the Social Security portion limited to the $118,500 earned-income threshold.

Employers also pay a matching 1.45 percent of wages to Medicaid, while those who are self-employed must pay both the employer and employee portions of FICA taxes.

The FICA tax rate, which is the combined social security tax rate of 6.2% and the Medicare tax rate of 1.45%, will be 7.65% for 2016 up to the social security wage base. The maximum social security tax employees and employers will each pay in 2016 is $7,347, also unchanged from 2015.

Earnings Limit for Social Security Unchanged and Additional Medicare Tax

The limit of annual earnings for those who both work and claim Social Security benefits remains the same for 2016 at $15,720 for those individuals who opt to receive benefits early (i.e. ages 62 through 65). For those individuals who turn 66 in 2016, the earning limit also remains at $41,880.

Unfortunately for highly compensated employees, Medicare takes a larger contribution because of a provision of the Affordable Care Act (ACA) that makes the employee-paid portion of the Medicare FICA tax subject to a 0.9 percent Additional Medicare Tax on amounts over a statutory threshold.

The threshold annual compensation amounts that trigger the Additional Medicare Tax are:

- $250,000 for married taxpayers who file jointly

- $125,000 for married taxpayers who file separately

- $200,000 for single and all other taxpayers

Where to go for Help on Withholding Questions

It is critical to keep your company safe and your management team informed and in compliance.

If you have questions regarding this, or other HR issues and practices, let us help you in managing your HR needs, payroll processes, and staying on top of compliance demands. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.

Social Security Wage Base Remains the Same for 2016

Social Security Wage Base Remains the Same for 2016