If there is any one thing employers and payroll management staff agree on it's that costs keep going up. And with signs of economic growth increasing, new hires will increase, as will the costs.

[This post was originally published May 14, 2015 and has been adapted and updated for 2017]

Any employer in California knows that running a company is a challenging venture. And, in California, managing the costs that come with hiring employees can seem prohibitive, as well. With increased family leave, paid sick leave, and other costly benefits - not to mention an ever-increasing minimum wage scale - it is a daunting task to make a business cost-effective and profitable.

It is critical for employers to have a fiscal and operational strategy that takes into consideration the projected and actual costs of a new hire before recruiting candidates. Hiring a new employee involves far more than a salary expense.

Hiring an Employee In California Costs More in 2017 Than Ever Before

For many employees, it can be easy to overlook the fact that there is more at stake than an additional salary for a new hire. An employer must consider the accumulated costs of recruiting, screening, hiring, training and on-boarding a new employee into the workplace. Depending on the position and the type of business, these costs can up to thousands of dollars.

Not every employee will require the entire process, but even a minimum wage employee can end up costing a company close to $4,000 in both direct and indirect turnover costs. An additional cost that is usually never taken into consideration is when an employer loses a new employee, or has to let them go and find a replacement.

California: The Rising Costs of a New Hire in the Golden State

While it may not be news to most employers in California, the actual costs associated with bringing on a new hire continues to rise. This is a business reality that can be sobering.

Consider that employer contributions to payroll taxes are among the highest in the nation. California also has one of the highest minimum wage rates, with certain cities and counties requiring even more than the current state-wide required $10.50 an hour. When one also considers that California ranks 33 out of the 50 states for corporate taxes, the fiscal prospects are increasingly grim.

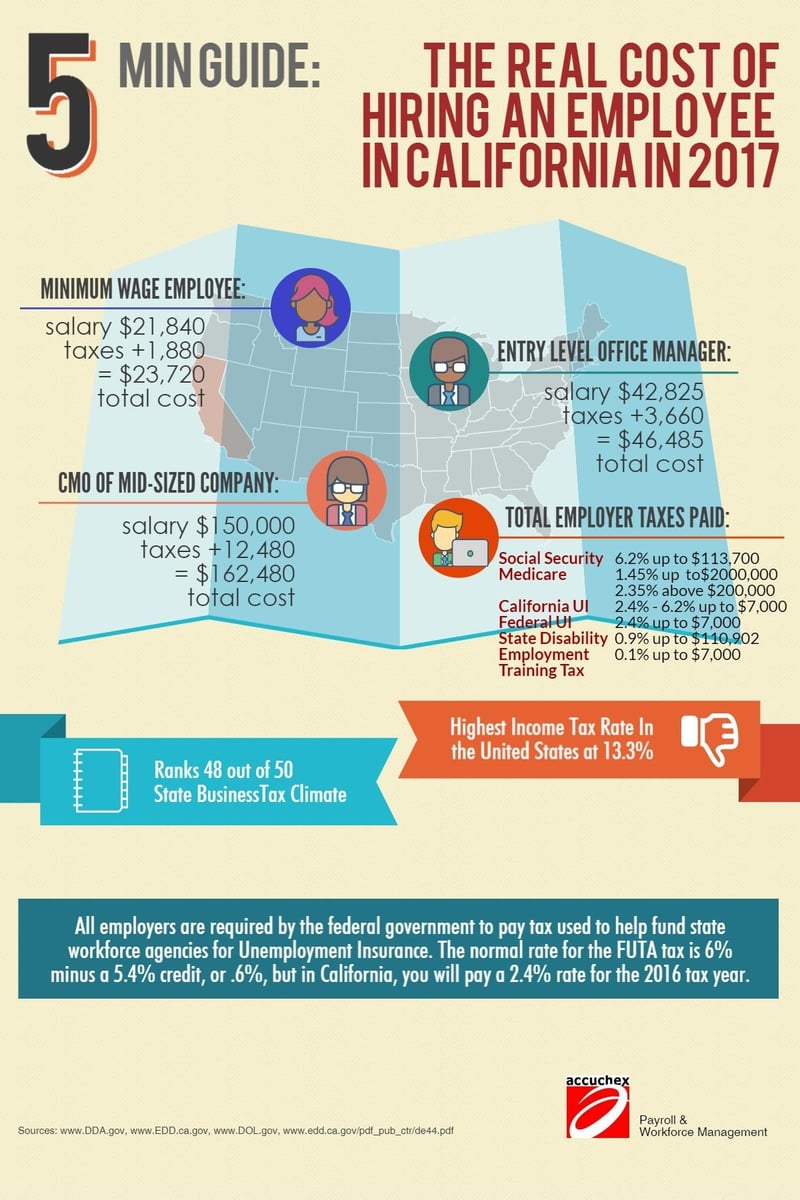

Add to that the fact that the overall business tax climate ranks near the bottom out of 50 states, and the added costs of the highest income tax rate in the nation, and it is easy to see why payroll management and optimizing human resources is a priority for California businesses.

Here is a short visual guide to some of the comparative hiring costs for new employees in California:

Share this Image On Your Site

In addition to these relatively fixed payroll contributions, the FUTA tax is almost certainly going to be at 2.7% for the 2017 tax year which will be due in January 2018. None of this takes into account the myriad of new legislation that adds to employer costs on a per employee basis.

The picture is not all grim, however. California continues to be a robust state economically in a number of key industries, and the prospects for turn-around are improving, according to many economic experts. For most employers, however, one of the economic realities of doing business in the state is that it can be expensive.

Professional Help for Your Payroll Management

Outsourcing is one of the key strategies for reducing overhead and employee costs, as well as streamlining operations. When a company outsources many of the more time consuming and labor intensive processes, the investment can bring huge dividends. One of the most common options for outsourcing is your payroll management functions.

A professional agency such a Accuchex can provide much-needed help with Human Resources needs and questions. Accuchex is a full spectrum Payroll Management Services provider offering expertise in Time Management, Insurance and Retirement issues, as well.

If you are looking for reliable resource for your HR issues, we can help. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision, or call Accuchex Payroll Management Services at 877-422-2824.

In addition, we invite you to take a tour of Time2Pay - it makes payroll easy: