The ObamaCare Employer Mandate / Employer Penalty that was set to begin in 2014 was delayed until later this year and 2016.

ACA Employer Mandate Delayed

The so-called “employer mandate” is a requirement of the Affordable Care Act (ACA) to have all businesses with 50 or more full-time equivalent employees (FTE) provide health insurance to at least 95% of their full-time employees and dependents, up to age 26, or pay a fee.

How the Employer Mandate Works

Firms with a 100 or more full-time equivalent employees (FTE), and having average annual wages above $250,000, are required to insure at least 70% of their full-time workers by 2015, and then 95% of workers by 2016.

Small businesses with between 50 and 99 employees must start insuring their full-time workers by 2016. The mandate does not apply to employers with less than 49 full-time employees. Employers with less than 25 FTE and average annual wages of less than $50,000 qualify for tax credits.

Play or Pay

If an employer doesn’t provide coverage, or provides coverage that doesn’t offer minimum value or it is deemed "unaffordable" then that employer must pay a per employee, per month “Employer Shared Responsibility Payment“.

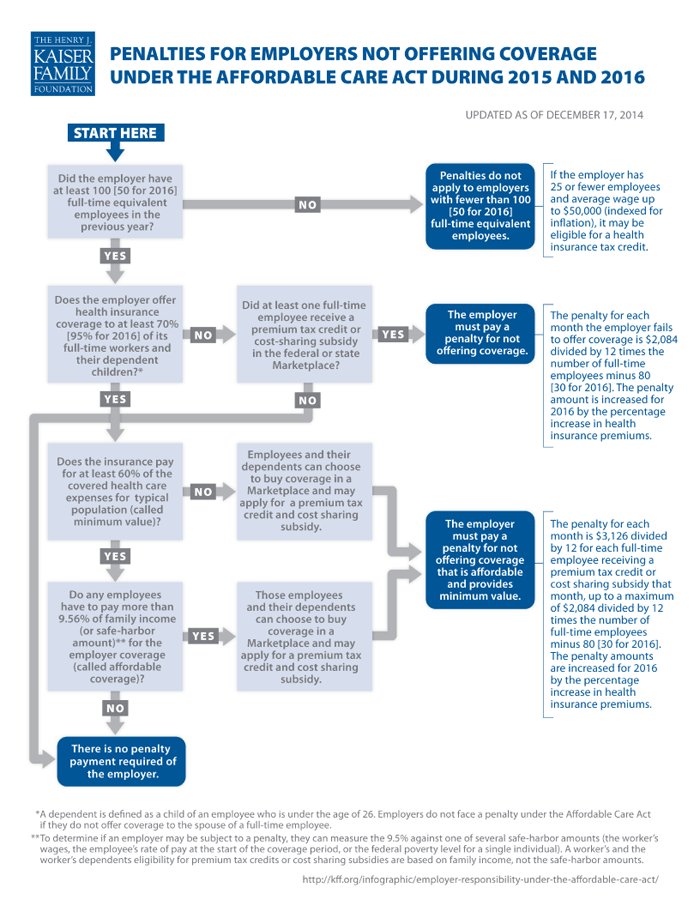

According the Henry J. Kaiser Family Foundation website: "The Affordable Care Act does not require businesses to provide health benefits to their workers, but larger employers face penalties if they don’t make affordable coverage available. The Obama Administration announced “transition relief” under which the penalties will go into effect in 2015 for employers with 100 or more employees and in 2016 for employers with 50 or more workers. This simple flowchart illustrates how those employer responsibilities work."

What is Affordable Employee Health Insurance?

According to the IRS, "affordable" means it costs no more than 9.5% of employee’s household income, for employee only coverage.If an employee’s share of the premium costs for employee-only coverage (not the entire family) is more than 9.5% of their yearly household income, the coverage is not considered affordable.

As an employer, you may not know your employee’s actual household income. Therefore, in order avoid a Shared Responsibility Payment for an employee simply make sure it costs no more than 9.5% of employee only income.

As a safe harbor employers can More information on safe harbors and affordability can be found below. See our page on affordable employer sponsored insurance for an in-depth look at affordability.

The IRS offers three "safe harbors" for ensuring affordability:

- 9.5% of an employee’s W-2 wages (reduced for any salary reductions under a 401(k) plan or cafeteria plan)

- 9.5% of an employee’s monthly wages (hourly rate x 130 hours per month)

- 9.5% of the Federal Poverty Level for a single individual

For additional information about this and other safe harbors see IRS.gov/aca.

Playing it safe:

The ObamaCare employer mandate has already prompted many companies to cut back the hours of full time workers to ensure that they are part-time status. Yet this is a counter-productive move for many businesses. Better to have the assurance of a professional ally such as payroll management service who can provide accurate and up-to-date advice and guidance.

Call to find out how Accuchex can smooth this process (and others) for your business. Let us help you in managing your HR needs, payroll processes, and staying on top of compliance demands. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.