January 1, 2017 will bring a number of changes for employers in California. One of these will be the new rules for e-pay and e-filing.

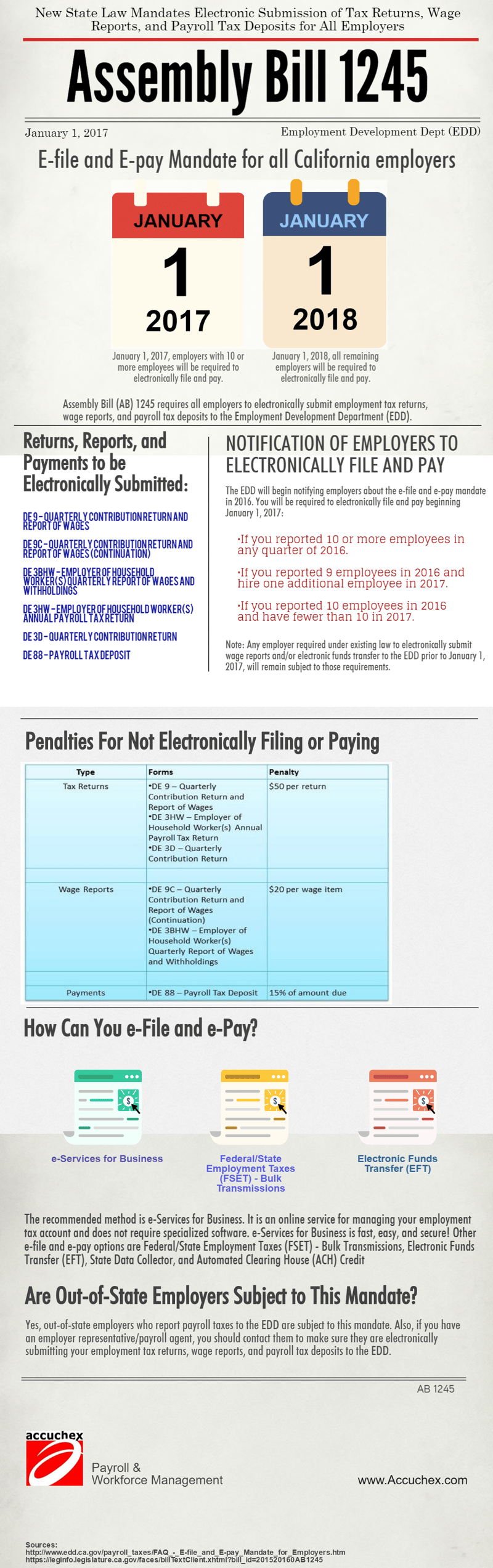

A new California labor law, AB 1245, has mandated the electronic submission of tax returns, wage reports and payroll deposits for all California employers. The law applies to all employers who had at least 10 full-time employees (FTE) in 2016.

According to information posted on the Employment Development Department (EDD) website, beginning on January 1, 2017, the new labor law will require employers with 10 or more employees to electronically submit all their employment tax returns, wage reports, and payroll tax deposits to the EDD.

In addition, the law provides that all remaining employers - regardless of the number of employees - will be subject to this requirement beginning January 1, 2018. Any employer required under existing law to electronically submit wage reports and/or electronic funds transfer to the EDD will remain subject to those requirements.

The law was authored by Assembly Member Ken Cooley and sponsored by Small Business California. The intent is to have it phase in over the next two years which hopefully gives employers plenty of time to prepare.

CA Labor Law AB 1245 and Waivers

This new law does provide for a waiver for employers who are unable to electronically submit employment tax returns, wage reports, and payroll tax deposits. The EDD began accepting these waiver requests from employers beginning in July 2016.

To request a waiver, employers must complete and submit the E-file and E-pay Mandate Waiver Request (DE 1245W).

Below is an infographic that illustrates an overview of the essential points behind AB 1245:

Share this Image On Your Site

How the New Labor Law Benefits Employers

The EDD has stressed that there are benefits for employers from the new requirements. In a recent letter issued to business owners, they highlighted the following:

- Increased data accuracy

- Data protection through encryption, which is safer and more secure than paper forms

- Reduced paper and mailing costs

- Lost mail eliminated

- Faster processing of returns and payments

While this is great news for most employers, there is still the maze of regulatory requirements to navigate.

How Your Business Can Benefit with its Payroll Compliance Needs

First of all, having an updated payroll compliance strategy will help your organization meet its payroll and tax obligations - while providing accuracy and timeliness.

Therefore, if you are looking for professional and reliable help to maintain your businesses payroll management and compliance, consider Accuchex.

Download our guide on Payroll Outsourcing - Free Download: Payroll Outsourcing Guide. It will help you to get an in-depth understanding of what is involved in outsourcing your payroll management. And, if you have an urgent question regarding your payroll management and compliance, please feel free to contact us at 877-422-2824.