As recent court cases have made painfully clear, employee classification is a potentially risky prospect. Incorrectly classifying employees as independent contractors can be incredibly costly for employers.

Employee Classification: Employers Must Avoid Common Mistakes

An article from Forbes.com noted that,

"This fundamental worker status issue has become one of the most consequential legal determinations around. If you’re in business and guess wrong, the liability for past years can be crushing."

And in 2013 the IRS Inspector General issued a report stating that employers too often still "guess wrong."

Why Even Hire Independent Contractors?

The truth for many businesses is that making use of independent contractors can be more efficient and cost-effective than relying solely on salaried employees.

Classifying a service provider as an independent contractor frees a business from several obligations such as tracking hours, paying required tax withholdings for wages, overtime, statutory benefits such as worker’s compensation coverage, unemployment benefits, health benefit plans and pension plans.

In addition, it limits liability for the errors and wrongs committed by the independent contractor.

Under California Labor Code Section 3353:

an “independent contractor” is defined as: Any person who renders service for a specified recompense for a specified result, under the control of his principle as to the result of his work only and not as to the means by which such result is accomplished.

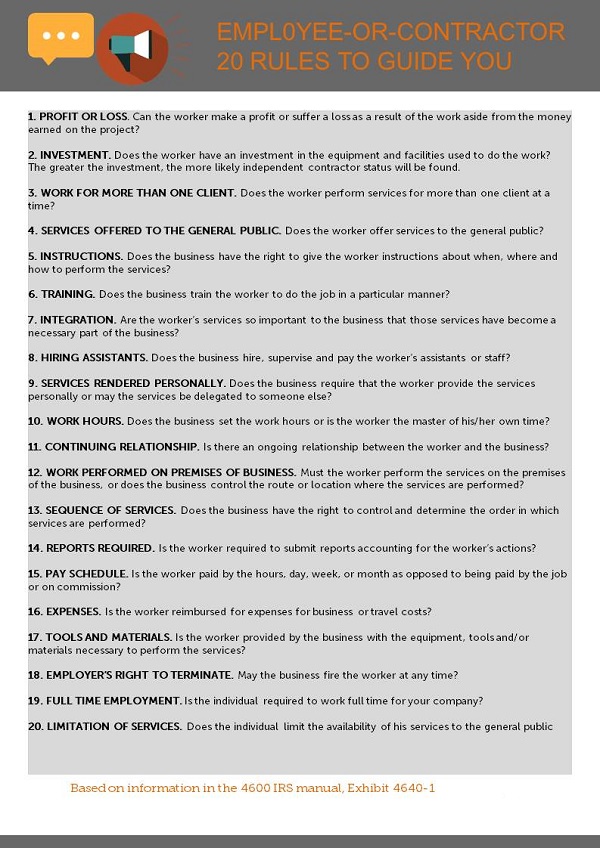

In addition, the IRS has a checklist of 20 factors, which are based on the common law as developed in past court cases and administrative hearings. These factors, found at 4600 IRS manual, Exhibit 4640-1, are illustrated here:

Generally, if a business is able to answer “Yes” to all first four questions, it is dealing with an independent contractor.

On the other hand, if a business is able to answer “Yes” to any of the remaining questions, it means that the worker is “probably” an employee.

Playing It Safe With Your Employee Classification

Remember that these factors are only a guide for determining whether or not a worker is an employee, and the IRS recognizes that the degree of importance of each factor varies depending upon the occupation and the actual context in which the services are performed.

As an employer, you are expected to exercise sound judgment in your classification of workers. To help in making that call you can use the following tactics to help minimize a potential mis-classification:

- Ensure that the business has a written agreement (an independent contractor agreement) with its independent contractors and that the independent contractor agreement describes the scope of the work to be performed, the compensation paid, the timing of the work and clearly define the independent contractor’s tax obligations;

- Ensure that the independent contractor has liability insurance, particularly if that contractor is a professional.

- Ensure that the independent contractor who is a professional has his or her pertinent license and that such license is current;

- Ensure that the independent contractor has a current business license from the city/county in which he or she is operating;

- Do not set independent contractor’s work hours;

- Do not provide the independent contractor with tools, equipment, software or supplies with which to perform his or her work;

- Do not provide the independent contractor any benefits, which the business provides to its employees.

- Do not retain or terminate or attempt to retain or terminate assistants or employees for or of the independent contractor.

- Ensure that the independent contractor submits invoices for his or her work.

With the recent pressure being put on employers by both the IRS and various state agencies, it is critical that businesses be fully informed regarding the correct status and proper employee classification of all their workers.

According to the IRS website:

"Businesses must weigh all these factors when determining whether a worker is an employee or independent contractor. Some factors may indicate that the worker is an employee, while other factors indicate that the worker is an independent contractor.

There is no “magic” or set number of factors that “makes” the worker an employee or an independent contractor, and no one factor stands alone in making this determination. Also, factors which are relevant in one situation may not be relevant in another.

The keys are to look at the entire relationship, consider the degree or extent of the right to direct and control, and finally, to document each of the factors used in coming up with the determination."

Professional Help With Your HR and Payroll Needs

If you are looking for reliable help with determining employee classification, we can help. If you are looking for additional help with your HR processes such as payroll management, you can get your Free Download: Payroll Outsourcing Guide to help you make an informed decision, or call Accuchex Payroll Management Services at 877-422-2824.