Expect more changes to California labor laws: Ovetime rules from the federal government will be enacted - eventually!

Expect more changes to California labor laws: Ovetime rules from the federal government will be enacted - eventually!

Back in March 2014, President Obama signed a Presidential Memorandum directing the Department of Labor to update the regulations defining which white collar workers are protected by the Wages and Fair Labor Standards Act's (FLSA) minimum wage and overtime standards. For California labor laws, overtime rules will require adjustments for payroll management practices.

The U.S. Department of Labor’s (DOL) has since proposed expansion of overtime protections which will impact millions of employees and their employers. The DOL last updated their regulations in 2004 which set the current salary threshold for exemption at $455 per week or $23,660 per year.

Proposed DOL Overtime Rules May Go into Effect Late 2016

Under the new rule, the DOL is proposing that the minimum salary level for these exemptions be set at the 40th percentile of earnings for full-time salaried workers. This has been estimated for a 2016 level to be about $970 a week, or $50,440 a year. A new minimum annual compensation needed to qualify for the highly compensated exemption is proposed to be set at the 90th percentile.

These proposed amendments to the Fair Labor Standards Act (FLSA) regulations more than double the minimum salary level (from $23,660 to over $50,000 per year in 2016) for certain employees deemed to be exempt from overtime as administrative workers, executives, professionals, and computer employees. The amendments also increase the minimum pay level necessary to be deemed an exempt "Highly Compensated Employee" from the current $100,000 to $122,148 per year.

Although originially anticipated for implementation early this year, the regulations are now likely to become effective in late 2016, or possibly even early 2017.

Overtime Rules and the Impact on California Employers

According the California Retailers Association, California’s retail industry currently operates over 164,200 stores with sales in excess of $571 billion annually and employing 2,776,000 people—nearly one fifth of California’s total employment.

The new overtime rules will have a significant impact on the management of this employment sector.

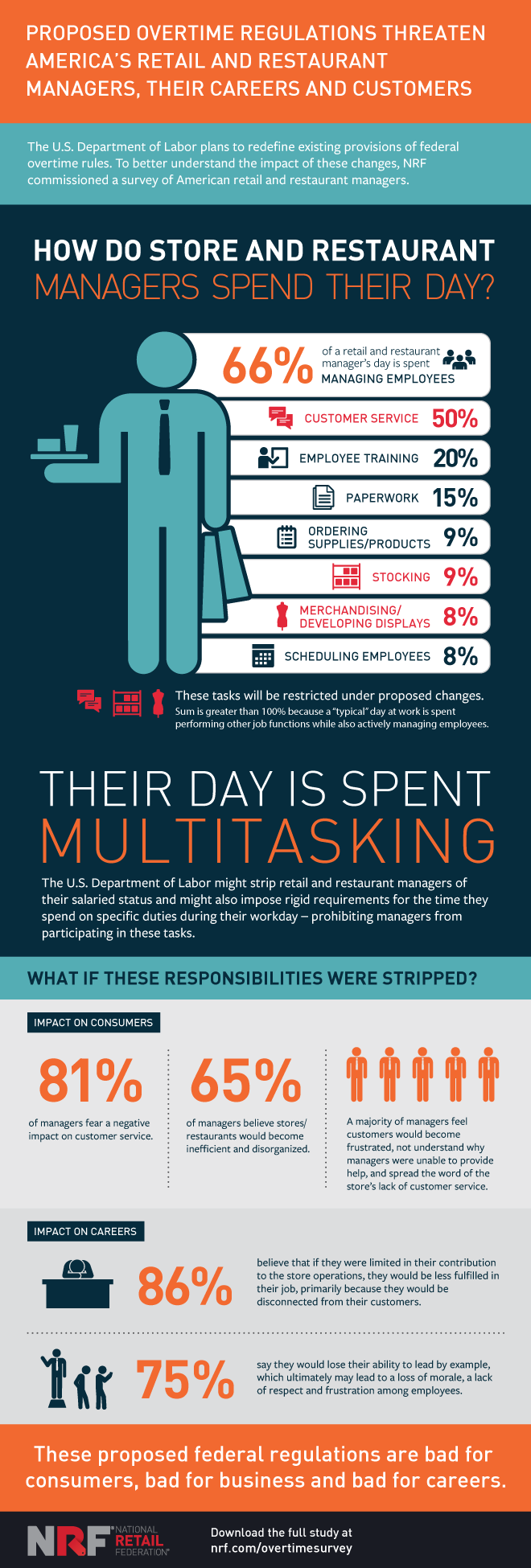

The National Retail Federation (NRF) released a study detailing the impact these proposed rules will have on the retail and restaurant industries. In addition, they put together an infogrpahic illustrating some of the specifics of the changes in the FLSA.

Payroll Management and DOL Overtime Rules

The U.S. Department of Labor’s (DOL) proposed expansion of overtime protections is expected to impact millions of employees and their employers. The DOL last updated their regulations in 2004 which set the current salary threshold for exemption at $455 per week or $23,660 per year.

Under the new rule, the DOL has proposed that the minimum salary level for these exemptions be set at the 40th percentile of earnings for full-time salaried workers. This has been estimated for a new level to be about $970 a week, or $50,440 a year. A new minimum annual compensation needed to qualify for the highly compensated exemption is proposed to be set at the 90th percentile.

According to the DOL website they want to update the salary level required for exemption to ensure that the Fair Labor Standards Act’s intended overtime protections are fully implemented, and to simplify the identification of nonexempt employees, thus making the executive, administrative and professional employee exemption easier for employers and workers to understand and apply.

Where to go for Help on Payroll Management Changes and Questions

It is critical to keep your company safe and your management team informed and in compliance.If you have questions regarding this, or other HR issues and practices, let us help you in managing your HR needs, payroll processes, and staying on top of compliance demands. Get your Free Download: Payroll Outsourcing Guide to help you make an informed decision or call Accuchex Payroll Management Services at 877-422-2824.