Understanding California labor laws is essential for Human Resources and Payroll departments since they are the two main players when it comes to ensuring that employees are being paid correctly and on-time.

[This blog was originally published in September 2015 and has been updated and revised.]

HR and payroll departments both need to understand the impact that an employee’s working schedule may have on his or her pay.

In California, the concept of “reporting time pay” was created to ensure employers aren’t taking advantage of workers by over-scheduling a shift and then sending them home if not needed. The Industrial Welfare Commission Orders require employers to pay their nonexempt employees for regularly scheduled but unworked time because of the lack of proper notification or inadequate scheduling by the employer.

According to the California Department of Industrial Relations (DIR),

“Each workday an employee is required to report to work, but is not put to work or is furnished with less than half of his or her usual or scheduled day's work, he or she must be paid for half the usual or scheduled day's work, but in no event for less than two hours nor more than four hours, at his or her regular rate of pay.”

In other words, in California, the “minimum” work hours per day can be between two to four hours, depending on the worker’s normal shift and the particular circumstances.

Understanding Reporting Time Pay Scheduling

The California Code of Regulations defines Reporting Time Pay as the time an employee must be paid for based on the employee’s scheduled shift. This part of California labor law serves to address employers who schedule employees for full shifts and then send them home because business doesn’t warrant them working the full shift.

In essence, if an employee is sent home by the employer before the end of at least half of their usual shift, they are entitled to be paid a minimum of half their shift.

Minimum Work Hours per Day and Reporting Time Pay

Because California labor law mentions a two hour minimum and a four hour maximum, many have construed this to mean the law requires employees to be scheduled a minimum number of work hours per day.

Not true.

The California Court of Appeals clarified this in the case of Aleman v. AirTouch Cellular, ruled on December 21, 2011. Although this case was brought regarding employee meetings, the ruling makes clear that the amount due to the employee is based on the actual length of their scheduled shift, and not on an arbitrary four hour, or eight hour shift.

In other words, in California, if a worker’s scheduled shift is only five hours, the amount of reporting time pay would be for two and half hours. However, because the law also requires a minimum of two hours reporting pay, a worker with a scheduled shift of just one and half hours, for example, would still be entitled to the two hour minimum reporting time pay.

In addition, the Aleman case clarified that California labor law does not require a minimum hour work day. It simply requires employers to pay at least half of the employee’s scheduled shift if the full shift isn’t worked.

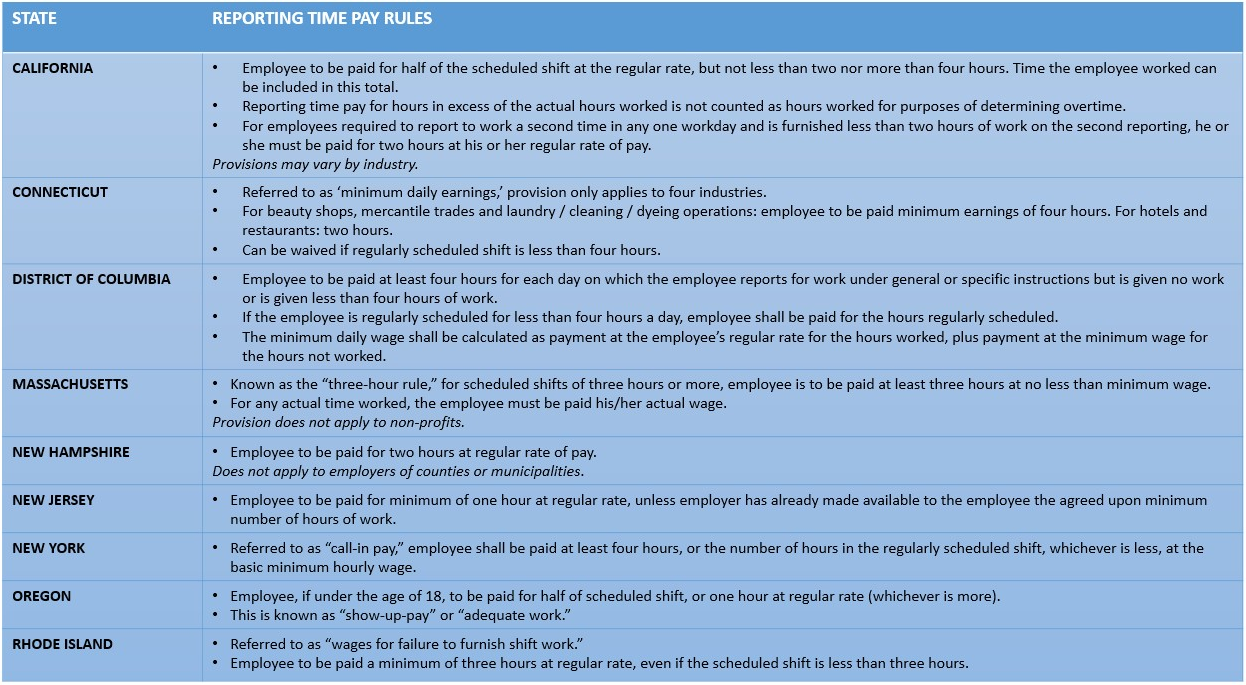

Reporting Time Pay In Other States

Reporting time wage obligations exist under other state reporting-time pay laws or wage agreements. According to the Society for Human Resource Management (SHRM) the vast majority of states do not have reporting-time pay laws. The states and jurisdictions that do have reporting-time pay laws are:

Here is a chart comparing the various state’s reporting-time pay regulations:

[Information courtesy Datamatics]

A Brief History of California Minimum Work Hours

Here is the current version of the Reporting Time Pay section of California’s Wage Order No. 7 notice:

REPORTING TIME PAY

(A) Each workday an employee is required to report for work and does report, but is not put to work or is furnished less than half said employee’s usual or scheduled day’s work, the employee shall be paid for half the usual or scheduled day’s work, but in no event for less than two (2) hours nor more than four (4) hours, at the employee’s regular rate of pay, which shall not be less than the minimum wage.

(B) If an employee is required to report for work a second time in any one workday and is furnished less than two (2) hours of work on the second reporting, said employee shall be paid for two (2) hours at the employee’s regular rate of pay, which shall not be less than the minimum wage.

(C) The foregoing reporting time pay provisions are not applicable when:

(1) Operations cannot commence or continue due to threats to employees or property; or when recommended by civil authorities; or

(2) Public utilities fail to supply electricity, water, or gas, or there is a failure in the public utilities, or sewer system; or

(3) The interruption of work is caused by an Act of God or other cause not within the employer’s control.

(D) This section shall not apply to an employee on paid standby status who is called to perform assigned work at a time other than the employee’s scheduled reporting time.

In 1943, California’s Industrial Wage Commission issued Wage Order No. 7, governing employees in the “mercantile industry,” broadly defined as businesses that operate for the purpose of purchasing, selling or distributing goods or commodities at wholesale or retail, or for the purpose of renting goods or commodities.

As originally established, Wage Order No. 7 mandated that employees receive reporting time pay if they were required to appear for work and in fact arrived at work, only to be provided four or less hours of work or no work at all. Under current terms, Wage Order No. 7 requires covered employers

(a) to pay at least two, but no more than four, hours’ worth of reporting pay at an employee’s regular rate of pay if the employee is required to report for work and does report, and is given less than half of the employee’s usual or scheduled day’s work, or

(b) to pay for at least two hours of work, at the employee’s regular rate of pay, if the employee is required to report for work a second time in any workday and is provided less than two hours of work on the second reporting.

Since Wage Order No. 7’s inception, employers, employees and the courts routinely had interpreted reporting time pay to require that an employee physically appear at the workplace to be deemed as having “reported for work.” As a result, prior to its shutdown in 2004, the Industrial Wage Commission never expressly defined what constituted “reporting to work.”

That was accomplished in 2019 with the California Court of Appeal, Second Appellate District’s decision in Ward v. Tilly’s Inc. The Court of Appeals interpreted the phrase to include calling in prior to a scheduled shift as being considered “reporting to work.”

Other Related State Pay Regulations

In addition to minimum hours worked and reporting time pay, California has other stipulations for various wage and salary situations, which can be found in the Division of Labor Standards Enforcement (DLSE) Enforcement Policies and Interpretations Manual. These include the following categories:

Hours Worked

California employers must pay non-exempt employees for all hours worked. “Hours worked,” as defined by the Industrial Welfare Commission, includes all time an employee is subject to the employer’s control and all time the employee is suffered or permitted to work, regardless of whether the employee is required to work or not. An employer must count all hours worked no matter where the work is performed, such as working from home.

Workweek

California defines a workweek as any seven consecutive 24-hour periods (168 consecutive hours) that begin with the same calendar day each week. The typical workweek begins each Sunday and ends the following Saturday, however, this need not be the case. The workweek may begin on any day of the week.

Waiting Time (on call/standby)

California employers must count waiting time or standby time as hours worked if the employees are unable to effectively use the time for their own purposes. The fact that the employees may not perform any actual work duties during the waiting or standby time does permit the employer to exclude the time from its hours worked calculation. If the employees are subject to the employer’s control, employees must be compensated when doing nothing or waiting for something to do.

Employers are permitted to pay employees a lower wage rate for waiting or standby time than they do for time when employees are performing actual job duties. Employers are permitted to pay employees a lower wage rate for waiting or standby time than they do for time when employees are performing actual job duties.

Sleeping Time

California requires employers to count employee sleep time as hours worked if the employees’ shifts are less than 24 hours. If employees work 24-hour shifts, an employer may deduct up to 8 hours of sleep time from the employees’ hours worked for that shift, so long as the employer provides adequate sleeping facilities and the employees actually receive 8 hours of sleep. Employers are permitted to pay employees a lower wage rate for waiting or standby time than they do for time when employees are performing actual job duties. If employees do not get at least 5 hours of uninterrupted sleep, the hour sleep period must be counted as hours worked.

Travel Time

Employers in California must count employee travel time as hours worked whenever it requires employees to travel, no matter when the travel occurs. This includes any time employees are required to travel out of town, whether on a one-day or overnight trip. An employer is not required to pay employees for any personal time taken while traveling, such as sleep time, meals, or sightseeing.

If an employee’s travel time to a transportation center (airport, bus station, train station, etc.) is about the same as the travel time to the employee’s usual workplace, the employer may begin counting the employee’s travel time as hours worked once he or she arrives at the transportation center.

Employers must also count as hours worked time spent by employees traveling from a central reporting location to their actual work location.

Employers are permitted to pay employees a lower wage rate for waiting or standby time than they do for time when employees are performing actual job duties. The employer must notify employees they will be paid the lower wage rate before the travel begins.

Meeting, Lecture, and Training Time

California employers must count time spent by employees at meetings, lectures, or training unless all four of the following criteria are met:

- attendance occurs outside regular working hours;

- attendance is voluntary;

- the meeting, lecture, or training is not directly related to the employees job; and

- the employee does not perform productive work while at the meeting, lecture, or training.

Attendance is considered not to be voluntary if employees are led to believe that their absence would lead to their termination or otherwise negatively impact their present working conditions in some other manner.

A meeting, lecture, or training is directly related to an employee’s job if it is designed to help the employee perform his or her current job duties more effectively as distinguished from preparing the employee for a new job or helping the employee learn a new skill.

The Impact of California's Minimum Wage Laws on Work Hours

At the other end of the scheduling spectrum is mandated minimum wage and overtime pay.

Traditionally, agricultural workers in California have been poorly served on both of these fronts. But the recent passage of new minimum wage laws and mandatory overtime may have a negative impact that was unintended.

A survey by Western Growers revealed these new California labor laws increasing the minimum wage and creating new rules for overtime pay would end up costing both farmworkers and the largely rural communities where they live.

The law resulted in California’s minimum wage being set at $10.50 per hour in 2017 and increasing to $15 per hour by 2023. This will inevitably have an impact on the hours worked by agricultural laborers. An additional aspect of the state’s new overtime law for agriculture began being phased in beginning in 2019 and will be completed by 2022.

Beginning in 2019, any hours worked over 55 hours per week, or more than nine-and-a-half hours on any workday, are now compensated as overtime pay. And, by 2022, agricultural employees working more than 40 hours in a week and eight hours in a day will be paid one and one-half times that employee’s regular rate of pay.

The same survey indicated that, because of the new laws, growers would be very likely to reduce their rising labor costs in a number of ways, including reducing California output, planting less labor-intensive crops and mechanizing farm work.

In addition, higher wage costs may force growers to cut back on employee benefits, including healthcare, vacation and retirement funding, according to survey results.

In fact, 80.4% of farm companies planned to cut back hours offered to farm workers. In addition, 78% of those growers polled said they planned to mechanize their existing more labor-intensive jobs.

The California Work Hours Take-Away

Employers don’t have to provide a minimum shift for their employees, but they do need to be careful on how they schedule them.

By understanding California labor laws and considering the impact when scheduling, employers can ensure that they stay compliant, and therefore minimize the cost related to reporting time pay due.

In addition, having online employee scheduling software can help ensure consistency, accuracy and compliance. With an automated schedule maker, you can set up standard shifts to accelerate the scheduling process. Efficient employee scheduling is important not only for compliance purposes, but for reducing time spent setting up, changing and assigning shifts and schedules.

With TimeSimplicity software from Accuchex you have an integrated schedule maker that will help with online shift scheduling. You simply set up a standard schedule for each employee, then just copy and paste it into each schedule period. From there, you can drag and drop shifts as much as you like, but you'll already have the basic structure in place.

In addition, you can arrange employee schedules with drag-and-drop simplicity. Changing shift start and end times is as effortless as dragging and dropping with your mouse. Managers can easily observe, monitor, and approve shift request changes online. And once a shift change is approved, TimeSimplicity automatically alerts the appropriate staff members.

Take Your Employee Scheduling to the Next Level

It doesn’t matter what your company does, payroll plays a key role in the success of any company. Partnering with Accuchex allows you to focus on your business yet still maintain peace of mind knowing your payroll is handled accurately.

The complete online payroll solutions provided by Accuchex covers everything you need to make sure your payroll is taken care of and that is why we are a trusted California payroll solutions provider. We offer our services in the California Bay area – North bay, South Bay and East bay, including San Francisco. Call Accuchex Payroll Management Services at 877-422-2824.