Employers in California are subject to the state's labor laws regarding meal and rest breaks. But staying in compliance with these laws can be problematic.

[This post has been updated and modified from an earlier post from 2016.]

Properly managing and complying with the regulatory maze of California labor laws can be difficult for employers and HR managers. As a central part of your payroll management functions it can be confusing and frustrating for both you and the employees.

Properly managing and complying with the regulatory maze of California labor laws can be difficult for employers and HR managers. As a central part of your payroll management functions it can be confusing and frustrating for both you and the employees.

There are issues such as split shifts, employee classification, and post-shift activities that require time to research to ensure proper compliance.

A strategic approach is to develop and implement processes for regularly reviewing and updating your compliance procedures and the ever changing California (and federal) labor laws.

Employers, Breaks, and California Labor Laws

No two businesses are alike and each one has its own employee considerations. Many only employ part-time employees, while others regularly have overtime hours worked and multiple shifts.

Some California businesses have employees working in a number of other states, or even in other countries. Others make regular use of independent contractors, hire piece-rate workers, or have mostly agricultural workers.

To complicate matters further, each year brings new legislation with additional or changed regulations and reporting requirements. The State of California Department of Industrial Relations (DIR) and other agencies work to keep employers apprised of these updates and changes.

However, without due diligence on the part of the business owners or their HR staff, it is easy to overlook certain requirements. And it is these potential oversights that can lead to costly claims, penalties, and even employee lawsuits.

When it comes to California labor law, breaks and meals are an often misunderstood issue.

An Overview of California Break Laws

There are a number issues that regularly crop up regarding California labor law for employers and managers, but here are some of the more common compliance "mine fields":

1. Hours Worked

According to the labor law, hours worked means:

“the time during which an employee is subject to the control of an employer, and includes all the time the employee is suffered or permitted to work, whether or not required to do so.”

The state of California permits “rounding” of employee time to the nearest one-tenth, five minutes, or a quarter hour for calculating actual hours worked. This approach is not allowed, however, if it can result in the failure to properly compensate your employees for the time they have worked.

Employers are allowed to disregard “insignificant periods of time” outside the regular scheduled working hours that cannot be precisely recorded for payroll purposes. This only applies, however, if these periods of time are occasional periods of time that only last a few seconds or minutes.

2. Meal Breaks

In California, employees must be provided with a meal break of at least 30 minutes if they work more than five hours in the day. This meal period must begin before, or at, the end of an employee’s fifth hour of work. If an employee works more than 10 hours in the same day, a second meal period is due.

Employers are not required to pay for meal periods and employees should clock in and out for meal periods.

In a 2012 court case, the California Supreme Court held that there is no prohibition on taking meal periods early in a shift, although this can result in an employee working more than five hours after the meal. In addition, the court also made it clear that employers must provide meal breaks, but that they do not need to require that employees use those breaks.

During meal breaks, employers must relieve employees of all duties, cannot regulate their activities, and must permit them a “reasonable opportunity” to take an uninterrupted 30-minute break. And, while employers cannot not “impede or discourage” employees from taking a meal break, they are not required to ensure that no work is being done during those breaks.

Meal periods may be waived in certain limited situations:

- If the employee will work no more than six hours total in the day, and the employee and employer agree to waive the meal period; and

- If the employee works between 10 and 12 hours, the second meal period may be waived if the first meal period was not waived.

If an employee works more than 10 hours employers must provide a second meal break of no fewer than 30 minutes. The second meal break must be provided no later than the end of an employee's 10th hour of work.

3. Rest Breaks

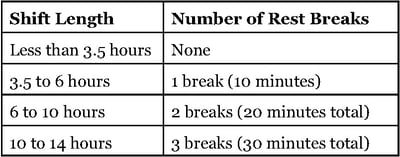

California labor law also requires that employers must “authorize and permit” employees to take one 10-minute rest period for each four-hour work period, or “major fraction thereof", which is anything more than two hours, according to the California Supreme Court.

As a result, rest periods must be provided as follows:

- Employees working between 3 1/2 and 6 hours are entitled to one paid 10-minute break

- Employees working between 6 hours and 10 hours are entitled to two paid10-minute breaks

- Employees working between 10 hours and 14 hours are entitled to three paid 10-minutes breaks; and so on.

However, a rest break is not required for employees whose total daily work time is less than three and one-half hours. Although no specific timing is required, the rest breaks should be taken, to the extent that it is reasonable, in the middle of each work period.

In general, if an employee is working an eight-hour shift, one rest break should be before the meal break, and one should be after. Remember, rest breaks count as time worked, and so employees must be paid for this time. Employers are also required to provide suitable resting facilities such as a break area or kitchen.

If the employer does not allow an employee to take a rest period, the employee is entitled to one hour of pay at the employee’s regular rate of pay for each workday that rest periods are not made available.

This includes not only rest periods required under California’s wage and hour laws, but also recovery periods, or cool down periods, allowed for employees to prevent heat illness under various state laws and regulations.

4. Break Periods for Piece-Rate Workers

In a recent case noted in the National Law Review,

"...the California Court of Appeals confirmed in Vaquero v. Stoneledge Furniture LLC, that non-exempt commissioned employees are entitled to enhanced compensation during rest and recovery periods. This ruling brings commissioned employees into alignment with the recent statutory changes for “piece-rate” employees in California."

The court's decision serves to remind employers with non-exempt commissioned employees that the 10 minute rest breaks required by California law must be separately tracked and compensated at the rates dictated by the statute.

Beginning January 1, 2016, the state Labor Code was updated with Section 226.2 which makes it more difficult for California employers who pay employees on a piece-rate basis for any part of their work.

- It requires employers to pay piece-rate employees for rest and recovery periods, and all periods of “other nonproductive time” separately from, and in addition to, their piece-rate pay.

- It makes wage statement compliance for piece-rate employers even more complex.

- As it does not contain a collective bargaining exemption, it also applies to employers of unionized employees.

Employers must pay piece-rate employees for rest and recovery periods at an hourly rate that is determined by dividing the employee’s total compensation for the workweek (excluding compensation for rest and recovery periods and overtime premiums) by the total hours worked during the workweek (not including rest and recovery periods).

The bill allows certain employers some additional time to program their payroll systems to comply with the “average hourly rate” requirement, provided that they retroactively pay employees the required amount.

Until April 30, 2016, certain large, newly acquired, or publicly-traded employers could pay employees the applicable minimum wage for rest and recovery periods, provided that they began paying employees based on the specified rate by April 30, 2016 and retroactively paid all affected employees the difference between minimum wage and the required average hourly rate (plus interest) by that date.

All other employers had to modify their payroll systems to comply with the new requirements as of January 1, 2016.

5. Training, Lectures and Meetings

In determining whether employees need to be paid for time spent attending training, lectures, and meetings, California follows the federal law. As such, time is not counted as “hours worked” if:

- Attendance is outside regular work hours

- Attendance is voluntary

- The course, lecture or meeting is not related directly to the employee’s job training, and

- The employee does not perform any productive work during the training, lecture or meeting

6. Agricultural Workers Break Laws

California has a very large agricultural workforce and there are special provisions in the California labor laws regarding agricultural and outdoor workers.

Individuals employed in agriculture and outdoor work such as landscaping and farming are now legally entitled to sufficient rest breaks when temperatures exceed 85 degrees. This is defined as a minimum five minutes in the shade, on an “as needed” basis.

This law applies to all employees, including illegal immigrants, who now have a number of rights and protections provided by the state of California under the provisions of California Bill 263.

If an employee does not receive the proper meal and rest periods the employer must pay to the employee one hour of pay as a penalty. This includes defined “recovery periods” or “cool down period afforded an employee to prevent heat illness.”

7. Travel Time

California law and federal law have different rules on travel time. California mandates that employees be paid for all hours they are engaged in work-related travel, regardless of whether those hours are during “normal” working hours, or for longer assignments.

The employer can, however, establish a different rate of pay for travel time. The California law does not require employers to pay employees for commuting to and from work, however.

California employers who require their employees to use personal vehicles for work may be liable for employee car accidents during a commute or even on a personal errand during "normal" work hours

8. Reporting Time Pay

Occasionally, employees may report to work, but for certain reasons are not put to work, or are provided with less than half of the usual or scheduled days’ wages. In those situations, employees are entitled to reporting time pay.

This means that employees are required to be paid for half of the usual or scheduled day’s work, but not less than two hours, nor more than four hours, of their normal wages.

Also, employees who are required to report for work a second time on any one workday and are furnished less than two hours of work on the second reporting must be paid for two hours at their regular rate of pay.

Requirements for providing reporting time pay do not apply if:

- Operations cannot continue or commence due to threats to employees or property

- Civil authorities recommend that operations not continue or commence

- There is a failure to public utilities or sewer system

- The interruption is caused by an act of God or other cause not in the control of the employer

Meal Penalties

If an employer fails to provide employees with a meal break or rest period that they are lawfully entitled to, the employer is then required to pay the employees one extra hour of pay at the employee’s regular hourly rate.

In addition, if an employer fails to provide multiple rest breaks or meal periods, employees can be entitled to up to one extra hour per workday for each missed rest period along with an additional one hour per workday for the missed meal breaks.

The meal penalty for the employer is the additional hour of pay for each meal period missed.

However, if a meal breaks and rest periods are made available to employees, but an employee chooses not to take them, their employer is not required to pay a penalty for the missing break or rest period. This applies even if the employer knew the employee skipped the meal break or rest period.

What this does not mean, however, is that employers can either encourage or pressure workers to skip breaks. If this does occur, the employer would most likely be subject to the penalty available to the employees.

California Meal & Rest Break Requirements

As noted previously in this post, there are specific California meal and rest break requirements that differ somewhat from what little the federal government provides. The number of meal breaks most employees must be given depends on the length of their shifts:

- An employee who works five hours or less is not entitled to a meal break.

- An employee who works more than five hours is entitled to one 30-minute meal break.

- An employee who works more than ten hours is entitled to a second 30-minute meal break

An employee’s first meal break must start before the end of the employee’s fifth hour of work. In addition, employees who are entitled to a second meal period, must take their meal break before the end of their tenth hour of work.

When an employer is providing a required meal break, that employer must:

- Relieve the employee of all duty

- Relinquish control of the employee’s activities

- Allow the employee a reasonable opportunity to take the entire 30-minute break uninterrupted

The employer is not, however, required to monitor meal breaks or prevent an employee from performing work during the meal break.

Meal Break Waivers

Meal break waivers are allowed in certain situations. For example, if an employee works six hours or less, the required meal period can be waived by the agreement and mutual consent of the employer and the employee. If, however, the employee works more than six hours, the meal period may not be waived even the employee requests it.

Additionally, if an employee works more than ten hours, but no more than twelve hours, the second required meal period can be waived, as well, by mutual consent of both the employer and the employee, but only if the first meal period was not waived.

There is no requirement that a California meal break waiver be in writing. In fact, a verbal waiver agreement is sufficient. However, it is still usually a good idea for employers to obtain a written waiver using a meal break waiver form to protect themselves. To obtain a meal break waiver form, California employers can go to organizations such as CalChamber.

California Meal and Rest Break Laws

Because the federal requirements are almost non-existent, California meal break law and California rest break law serves to provide workers with time to both eat meals while working and to take reasonable breaks from their labor. In addition, under California law meal breaks and rest periods ensure that employees have reasonable working conditions.

The California meal period law provides for 30-minute breaks for meals that apply to most employees. In addition, rest breaks or rest periods, are also provided for in California law.

Federal Meal Break Laws

According to an article at Nolo.com,

“The federal wage and hour law, called the Fair Labor Standards Act (FLSA), doesn't require employers to provide meal or rest breaks. Some states have stepped into the breach to require such breaks, but others have not.”

Because there is essentially no federal meal break law requiring that employees be provided free time to eat while at work, most states have their own legislation for this.

Payroll Management Best Practices and California Labor Law

As a business owner, or HR or payroll manager, you have a number of options for your payroll functions. Software that can be installed in-house, or cloud-based programs offer a good alternative.

But if you really want to take full advantage of the benefits available to you, outsourcing to a provider like Accuchex can still be the best decision.

If you are currently looking to invest in outsourcing, download our free resource, the Payroll Outsourcing Guide, to help you make an informed decision.

Or call Accuchex Payroll Management Services at 877-422-2824.

In addition, you can find helpful guidance with our California Labor Laws: Breaks, Employees, And The Rules guide by clicking this button: